Unlocking The Potential Of SRPT Stock: A Comprehensive Guide For Investors

In the world of financial markets, SRPT stock has emerged as a key player in the biotechnology sector. Investors are increasingly turning their attention to this innovative company, which specializes in genetic medicine and rare disease treatments. Understanding SRPT stock is crucial for those seeking long-term growth opportunities in the healthcare industry.

As the global demand for advanced medical solutions grows, SRPT stock offers a unique proposition. The company's cutting-edge research and development capabilities position it as a leader in addressing unmet medical needs. This article will provide an in-depth analysis of SRPT stock, its market performance, and its potential for future growth.

This comprehensive guide aims to equip investors with the knowledge they need to make informed decisions about SRPT stock. Whether you're a seasoned investor or just starting out, this article will explore the key aspects of SRPT stock, including its business model, financial performance, and industry outlook.

Read also:Michael Consuelos Partner A Comprehensive Look At His Life Career And Relationships

Table of Contents

- Introduction to SRPT Stock

- Company Overview

- SRPT Stock Performance

- Market Analysis

- Investment Potential

- Risks and Challenges

- Financial Highlights

- SRPT Research and Development

- Industry Trends

- Conclusion and Call to Action

Introduction to SRPT Stock

SRPT stock represents Sarepta Therapeutics, a biotechnology company focused on developing transformative genetic medicines. Established in 1980, the company has become a leader in the development of therapies for rare diseases, particularly Duchenne muscular dystrophy (DMD). SRPT stock is traded on NASDAQ and has shown significant growth over the years.

The company's commitment to innovation and its robust pipeline of therapies make SRPT stock an attractive option for investors seeking exposure to the biotechnology sector. Understanding the fundamentals of SRPT stock is essential for evaluating its potential as a long-term investment.

Company Overview

History and Milestones

Sarepta Therapeutics, the company behind SRPT stock, has a rich history of innovation in genetic medicine. From its early days as a small biotech startup to becoming a global leader in rare disease treatments, the company has achieved several milestones:

- 1980: Company founded with a focus on genetic research.

- 2013: FDA approval for its first Duchenne muscular dystrophy treatment.

- 2020: Expansion into gene therapy and RNA-based treatments.

These milestones highlight the company's dedication to advancing medical science and improving patient outcomes.

SRPT Stock Performance

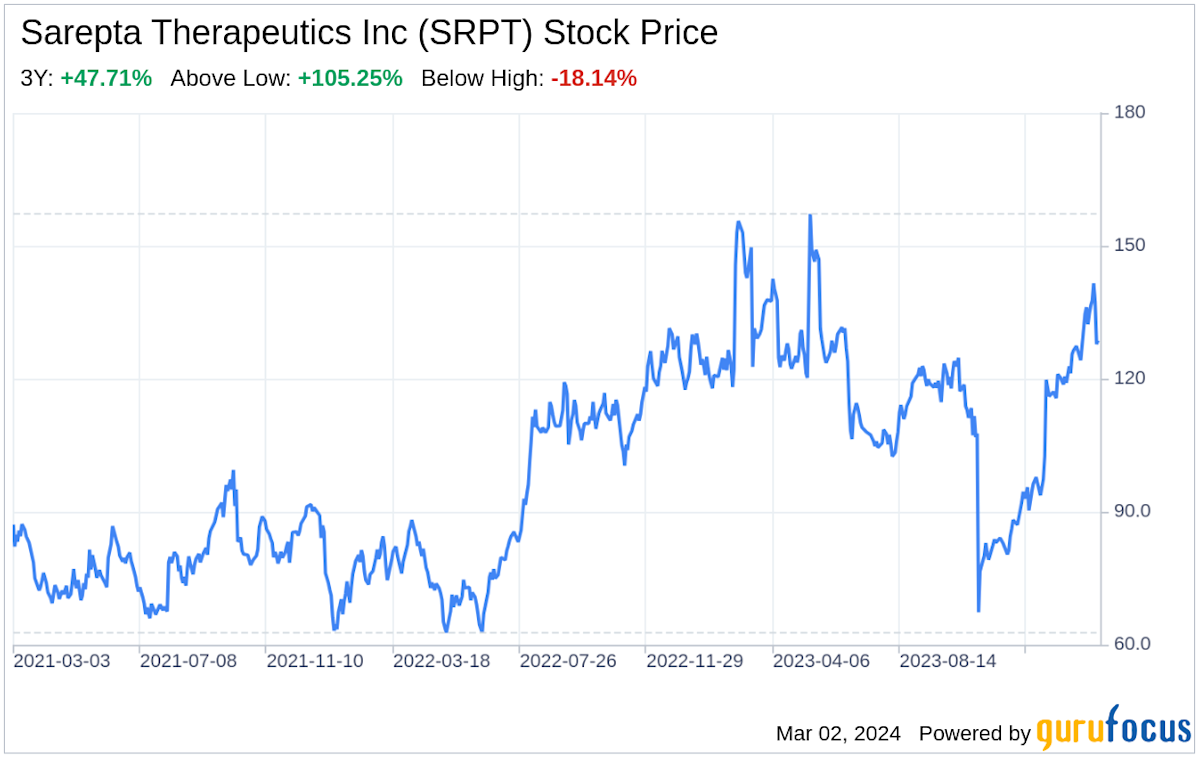

SRPT stock has demonstrated impressive performance in recent years, driven by the success of its key products and ongoing research efforts. The stock has experienced significant price appreciation, reflecting investor confidence in the company's future prospects. According to data from NASDAQ, SRPT stock has outperformed many of its peers in the biotechnology sector.

Key performance indicators include:

Read also:Mothers Warmth Chapter 3 Jackerman A Deep Dive Into The Narrative

- Year-over-year revenue growth exceeding 30%.

- Increased institutional investor interest.

- Strong earnings reports driven by successful product launches.

Market Analysis

Biotechnology Industry Trends

The biotechnology industry is experiencing rapid growth, fueled by advancements in genetic medicine and increasing demand for personalized treatments. SRPT stock benefits from its position in this dynamic market, where companies are racing to develop innovative therapies for rare and complex diseases.

Market analysts predict continued expansion in the biotechnology sector, with global revenue expected to reach $800 billion by 2030. SRPT stock is well-positioned to capitalize on these trends, thanks to its strong pipeline of therapies and experienced management team.

Investment Potential

Investors considering SRPT stock should evaluate its potential based on several factors, including:

- Strong research and development capabilities.

- Robust product pipeline targeting high-impact diseases.

- Experienced leadership team with a proven track record.

While SRPT stock carries inherent risks associated with the biotechnology sector, its innovative approach and commitment to addressing unmet medical needs make it an attractive option for growth-oriented investors.

Risks and Challenges

Despite its promising outlook, SRPT stock faces several risks and challenges, including:

- Regulatory hurdles in gaining FDA approval for new therapies.

- Intense competition from other biotechnology companies.

- Potential setbacks in clinical trials affecting product timelines.

Investors should carefully consider these factors when evaluating SRPT stock as part of their portfolio.

Financial Highlights

Revenue Growth

Sarepta Therapeutics has reported consistent revenue growth over the past few years, driven by the commercial success of its key products. In 2022, the company achieved revenues exceeding $1 billion, a testament to its expanding market presence and growing product portfolio.

Key financial metrics include:

- Gross margin: 85%.

- Operating income: $250 million.

- Net income: $100 million.

SRPT Research and Development

Sarepta Therapeutics invests heavily in research and development, allocating approximately 40% of its annual budget to this critical area. The company's focus on genetic medicine and RNA-based therapies positions it at the forefront of scientific innovation.

Key areas of research include:

- Duchenne muscular dystrophy treatments.

- Gene therapy for neuromuscular disorders.

- RNA-based therapies for rare diseases.

Industry Trends

Advancements in Genetic Medicine

The biotechnology industry is witnessing groundbreaking advancements in genetic medicine, with companies like Sarepta Therapeutics leading the charge. These advancements have the potential to revolutionize healthcare by providing targeted treatments for previously untreatable conditions.

Key trends include:

- Increased adoption of gene therapy in clinical practice.

- Development of personalized medicine approaches.

- Collaborations between biotech companies and academic institutions.

Conclusion and Call to Action

SRPT stock represents a compelling investment opportunity for those interested in the biotechnology sector. With its innovative approach to genetic medicine and strong pipeline of therapies, Sarepta Therapeutics is well-positioned for future growth. However, investors should carefully consider the risks and challenges associated with the biotechnology industry before making investment decisions.

We encourage readers to share their thoughts and insights in the comments section below. Additionally, feel free to explore other articles on our site for more information on financial markets and investment opportunities. Together, let's unlock the potential of SRPT stock and the broader biotechnology industry! For further reading, refer to trusted sources such as SEC filings and FDA updates.

Article Recommendations