PPP Loan Warrant List New Jersey: Your Comprehensive Guide To Understanding And Navigating

Hey there, folks! If you’ve been keeping up with the latest in financial news, you might have heard whispers about the PPP Loan Warrant List in New Jersey. But what exactly is it? Why should you care? And how does it impact you or your business? Let’s dive right into it because this isn’t just another boring financial topic—it’s your money, your life, and your future we’re talking about here.

Picture this: the Paycheck Protection Program (PPP) was introduced as a lifeline for small businesses struggling during the pandemic. But like any government program, there’s a flip side. Some folks took advantage of the system, leading to investigations and legal consequences. Enter the PPP Loan Warrant List, a document that’s making waves in New Jersey and beyond.

This article isn’t just about throwing numbers and legal jargon at you. It’s about breaking down the complexities so you can make informed decisions. Whether you’re a small business owner, a curious citizen, or someone looking to protect their assets, this guide has got you covered. So grab a cup of coffee, sit back, and let’s unravel the mystery together!

Read also:Tory Kittles Wife A Comprehensive Look Into Her Life And Relationship

What Exactly is the PPP Loan Warrant List?

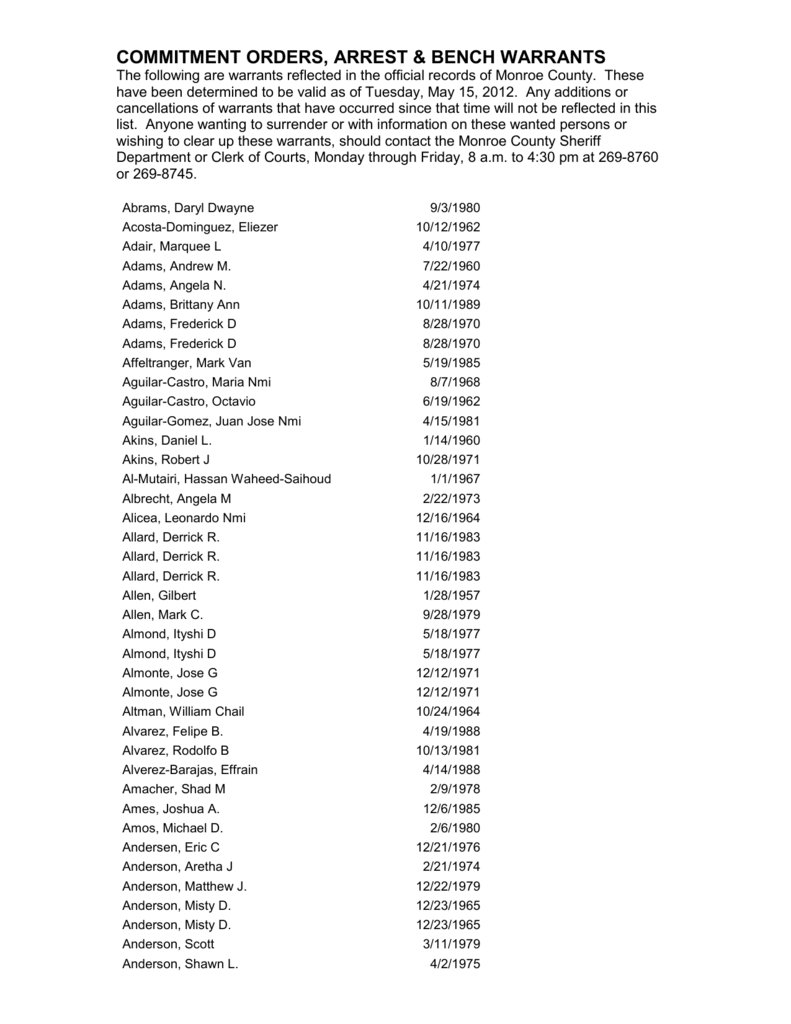

Alright, let’s cut to the chase. The PPP Loan Warrant List is essentially a roster of individuals and businesses that have faced legal action due to alleged misuse of PPP funds. In New Jersey, this list has grown significantly, highlighting the state’s commitment to holding wrongdoers accountable. But here’s the kicker: not everyone on the list is a big-time fraudster. Some are small business owners who made honest mistakes—or so they claim.

Now, why should you care? Well, if you’re a business owner in New Jersey, understanding this list can help you avoid potential pitfalls. Plus, it’s always good to stay informed about what’s happening in your community, right?

Why New Jersey is at the Center of Attention

New Jersey has emerged as a hotspot for PPP loan investigations. With its bustling economy and diverse business landscape, it’s no surprise that the state has seen its fair share of misuse. But here’s the deal: New Jersey isn’t just cracking down on the big players. Small businesses are also under scrutiny, and that’s where things get interesting.

Key Stats and Figures

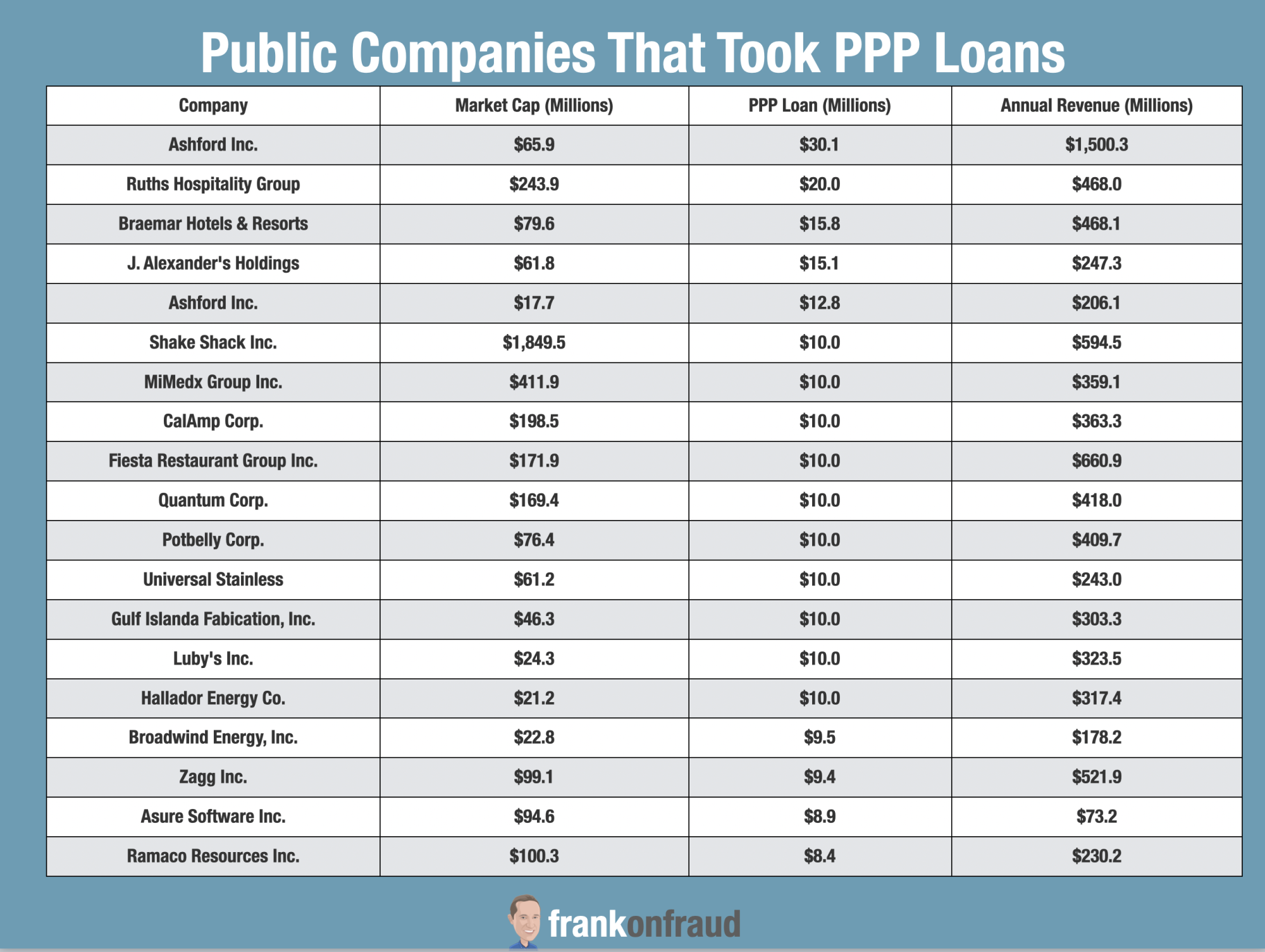

Let’s sprinkle in some numbers to paint a clearer picture:

- Over 1,000 warrants issued in New Jersey alone.

- More than $100 million in suspected fraudulent PPP loans.

- Dozens of arrests, with more expected as investigations continue.

These numbers are staggering, and they highlight the scale of the issue. But remember, not all businesses on the list are guilty. Some are fighting back, claiming that the system is flawed and unfair.

How Did We Get Here?

The PPP program was designed to help small businesses survive the pandemic by providing forgivable loans. Sounds great, right? But with great opportunity comes great temptation. Some folks saw the program as a golden ticket to easy money, leading to widespread abuse.

Read also:Jay White Manson A Rising Star In The World Of Wrestling

In New Jersey, the situation was exacerbated by the state’s dense population and competitive business environment. With so many businesses vying for limited funds, it was only a matter of time before things got messy.

Who’s on the PPP Loan Warrant List?

So, who exactly ends up on this infamous list? Well, it’s a mix of characters, ranging from small business owners to corporate executives. Here’s a breakdown:

Types of Offenders

- Business owners who inflated payroll numbers to secure larger loans.

- Individuals who applied for multiple loans under different business names.

- Companies that failed to use the funds for their intended purpose.

But here’s the twist: not everyone on the list is a bad guy. Some are victims of paperwork errors or miscommunication. That’s why it’s crucial to understand the nuances before jumping to conclusions.

What Happens After You’re on the List?

Being on the PPP Loan Warrant List isn’t the end of the world, but it certainly isn’t a picnic. Here’s what typically happens:

- Law enforcement agencies initiate investigations.

- Business owners may face criminal charges, including fraud and embezzlement.

- Repayment of misused funds is often required.

But here’s the silver lining: if you believe you’ve been wrongfully accused, you have the right to defend yourself. Legal representation can make all the difference in these situations.

How Can You Protect Yourself?

If you’re a small business owner in New Jersey, there are steps you can take to stay off the warrant list:

Tips for Compliance

- Keep detailed records of all PPP-related expenses.

- Ensure that funds are used exclusively for payroll and other approved purposes.

- Consult with a financial advisor or legal expert if you’re unsure about any aspect of the program.

Remember, prevention is key. By staying organized and informed, you can avoid unnecessary headaches down the road.

What Does the Future Hold?

As investigations continue, the PPP Loan Warrant List in New Jersey is likely to grow. But here’s the hopeful part: the government is learning from its mistakes and refining the program to prevent future abuse. This means better safeguards for businesses and a more transparent system overall.

Potential Changes

- Stricter application processes.

- Enhanced oversight and auditing.

- Improved communication with business owners.

While change takes time, the goal is to create a program that truly serves its intended purpose: helping small businesses thrive.

Where Can You Find More Information?

If you want to dive deeper into the PPP Loan Warrant List, there are plenty of resources available:

- Official government websites for the latest updates.

- Local news outlets for breaking stories and analysis.

- Legal experts who specialize in PPP-related issues.

Staying informed is the best way to protect yourself and your business. So don’t be afraid to do your homework!

Final Thoughts

Alright, let’s wrap things up. The PPP Loan Warrant List in New Jersey is a complex issue with far-reaching implications. But by understanding the basics and taking proactive steps, you can navigate the waters safely.

Here’s what we’ve learned:

- The list is a response to widespread misuse of PPP funds.

- New Jersey is at the forefront of investigations, with significant resources dedicated to the cause.

- Prevention and compliance are key to avoiding legal trouble.

Now, here’s where you come in. If you’ve found this article helpful, share it with your friends and colleagues. Knowledge is power, and the more people who understand this issue, the better off we’ll all be. And hey, if you have any questions or thoughts, drop them in the comments below. Let’s keep the conversation going!

Until next time, stay savvy and stay safe out there!

Article Recommendations