Paycheck Protection Program Warrant List: A Comprehensive Guide For Small Business Owners

Let’s face it, folks, the Paycheck Protection Program (PPP) has been a game-changer for countless small businesses across America. But as with any government program, there’s a lot to unpack, especially when it comes to the PPP warrant list. Whether you’re a business owner trying to navigate the waters or just curious about how this all works, we’ve got you covered. So, grab your coffee, sit back, and let’s dive in.

Imagine this: you’re running a small business, and suddenly, the pandemic hits like a freight train. Your revenue tanks, and you’re wondering how you’ll keep the lights on and your employees paid. Enter the Paycheck Protection Program, a lifeline designed to help businesses like yours stay afloat. But what happens when the program ends, and the feds start looking into who got what? That’s where the warrant list comes into play.

Now, before we get too deep into the weeds, let’s clarify something. The PPP warrant list isn’t exactly the most talked-about topic at dinner parties, but it’s crucial for anyone who’s ever dipped their toes into the PPP pool. It’s all about accountability, transparency, and making sure that the funds went to the right places. Stick around, and we’ll break it down step by step.

Read also:Meet The Cast Of Anne With An E A Deep Dive Into The Talented Ensemble Behind The Beloved Series

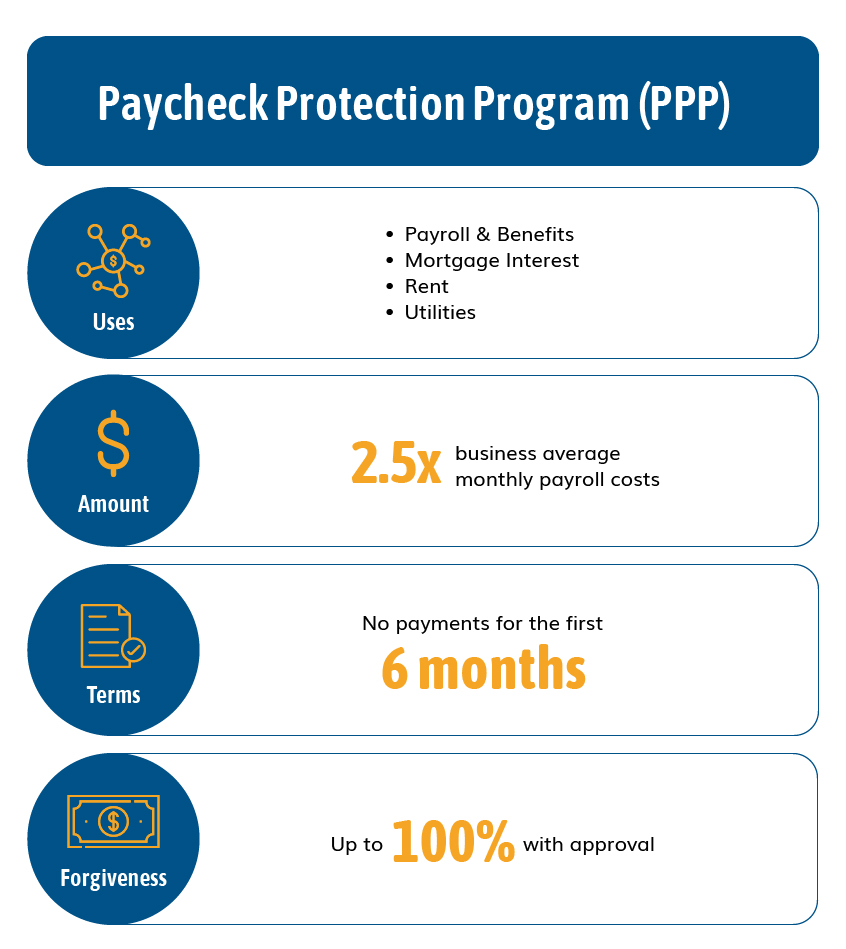

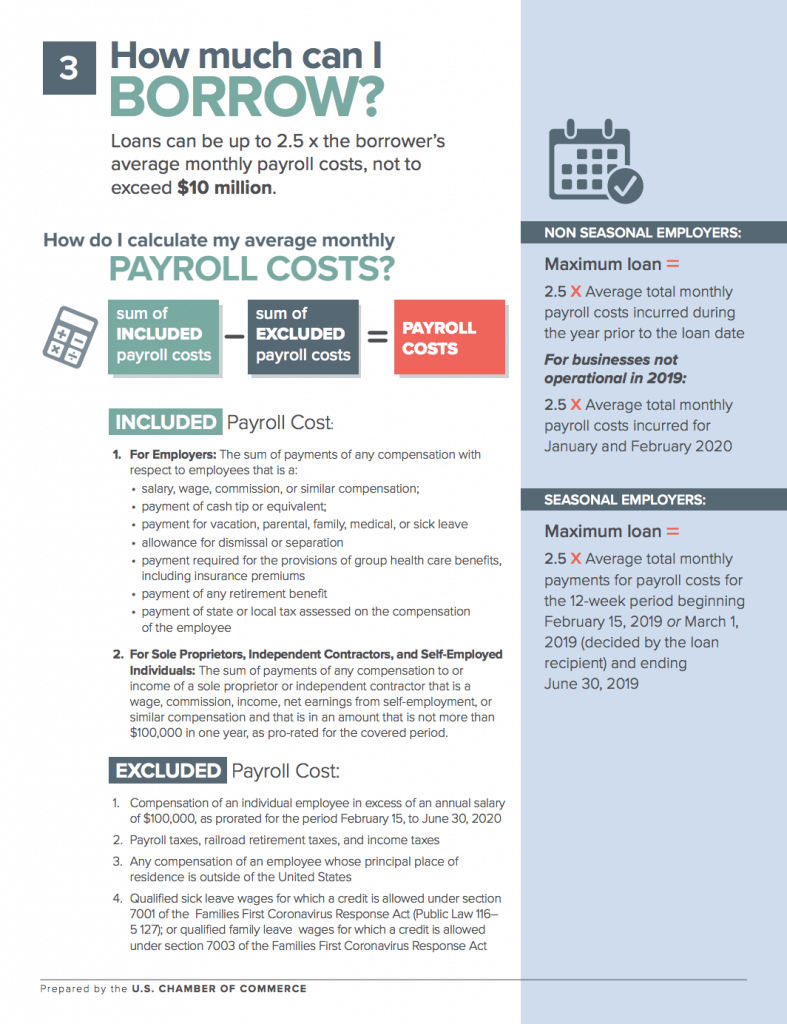

What Exactly is the Paycheck Protection Program?

Alright, let’s start with the basics. The Paycheck Protection Program, or PPP, was created under the CARES Act back in 2020. It’s like a safety net for small businesses struggling during the pandemic. Basically, the government handed out forgivable loans to help cover payroll, rent, utilities, and other essential expenses. If you used the money for the intended purposes, you could get the loan forgiven. Sounds pretty sweet, right?

But here’s the kicker: not everyone plays by the rules. And that’s where things can get messy. The PPP warrant list is essentially a list of businesses or individuals who may have misused or improperly obtained these funds. Think of it as the government’s way of saying, “Hey, we’re watching you.”

Now, don’t freak out if you’re reading this and thinking, “Wait, am I on the list?” We’ll get into that in a bit. For now, just know that the PPP was a massive undertaking, and with any big program, there’s bound to be some scrutiny afterward.

Why Should You Care About the PPP Warrant List?

Here’s the deal: if you’re a small business owner, you need to care about this stuff. The PPP warrant list isn’t just some random document sitting in a government database. It’s a tool used to ensure that the funds were distributed fairly and ethically. If your business is flagged, it could mean trouble down the line.

Let’s break it down a bit further:

- Transparency: The public has a right to know how taxpayer money is being spent. The warrant list helps shed light on potential misuse of funds.

- Accountability: Businesses that took advantage of the program could face legal consequences. This includes fines, penalties, or even criminal charges in extreme cases.

- Reputation: Being on the warrant list can damage your business’s reputation. It’s not something you want plastered all over the news.

So, yeah, it’s a big deal. But don’t panic just yet. We’re here to help you understand what it all means and how you can stay on the right side of things.

Read also:Junko Furuta Case The Dark Truth Behind Japans Most Infamous Crime

How Does the PPP Warrant List Work?

Now that we’ve covered the basics, let’s talk about how the warrant list actually works. It’s not as complicated as it might sound, but there are a few key points you need to know.

Step 1: Application and Approval

When the PPP first rolled out, businesses applied for loans through participating lenders. The SBA (Small Business Administration) reviewed these applications to determine eligibility. If approved, the funds were disbursed to the business.

Step 2: Loan Forgiveness

Once the funds were in your hands, it was up to you to use them according to the guidelines. If you followed the rules, you could apply for loan forgiveness. This meant you wouldn’t have to pay the money back. Pretty awesome, right?

Step 3: Audits and Investigations

Here’s where the warrant list comes in. After the program ended, the SBA and other government agencies started auditing businesses to ensure compliance. If they found any irregularities, the business could be added to the warrant list.

Fun Fact: As of 2023, the SBA has recovered billions of dollars in improperly disbursed PPP funds. That’s a lot of money, folks!

Who Can End Up on the PPP Warrant List?

So, who exactly ends up on this list? Well, it’s not just the big guys. Small businesses, individuals, and even nonprofit organizations can find themselves on the PPP warrant list if they’re suspected of wrongdoing. Here are some common reasons:

- Providing false information on loan applications.

- Using funds for purposes not covered by the PPP guidelines.

- Failing to meet loan forgiveness requirements.

- Engaging in fraudulent activities related to the program.

Now, before you start stressing, remember that being on the warrant list doesn’t automatically mean you’re guilty. It just means you’re under investigation. That’s why it’s so important to keep accurate records and follow the rules from the get-go.

How to Check If Your Business is on the PPP Warrant List

Alright, let’s say you’re wondering if your business made the list. How do you check? It’s actually pretty straightforward. The SBA maintains a public database of businesses flagged for investigation. You can search by name, location, or loan amount.

Here’s what you need to do:

- Visit the SBA’s official website.

- Look for the section on PPP audits and investigations.

- Use the search tool to check for your business name or other relevant details.

If you find your business on the list, don’t panic. Contact a legal professional immediately to discuss your options. Trust me, you don’t want to go it alone.

What Happens If Your Business is on the Warrant List?

So, what happens if you’re officially on the PPP warrant list? Well, it depends on the severity of the issue. Here are some possible outcomes:

- Repayment: You may be required to repay the loan in full.

- Fines: If you’re found to have misused funds, you could face hefty fines.

- Criminal Charges: In extreme cases, individuals or businesses could face criminal prosecution.

- Reputation Damage: Being on the warrant list can harm your business’s reputation, making it harder to attract customers or secure future loans.

But here’s the good news: if you can prove that you followed the rules, you may be able to clear your name. That’s why documentation is key. Keep every single piece of paperwork related to your PPP loan in a safe place. You never know when you’ll need it.

Preventing Issues with the PPP Warrant List

They say prevention is the best medicine, and that couldn’t be truer when it comes to the PPP warrant list. Here are some tips to help you stay off the list:

- Follow the Guidelines: Make sure you understand and adhere to all PPP rules and regulations.

- Keep Accurate Records: Document everything related to your loan, from application to forgiveness.

- Consult Professionals: If you’re unsure about anything, don’t hesitate to consult a lawyer or accountant.

- Stay Updated: Keep an eye on any changes to the PPP program or related investigations.

Trust me, a little extra effort now can save you a lot of headaches down the road.

Real-Life Examples of PPP Warrant List Cases

To give you a better idea of what we’re talking about, let’s look at a couple of real-life examples. These cases highlight the importance of following the rules and maintaining transparency.

Case 1: The Restaurant Chain

A well-known restaurant chain was flagged for improperly using PPP funds. Investigators found that the company had used the money to pay for luxury vacations and personal expenses. The result? Millions in fines and a tarnished reputation.

Case 2: The Small Bakery

On the flip side, a small bakery owner was initially worried about being on the warrant list. But after providing detailed records and proving compliance, the investigation was dropped. Moral of the story: documentation is your best friend.

These examples show that the PPP warrant list isn’t one-size-fits-all. Each case is unique, and the outcome depends on the specifics.

Conclusion: Stay Informed, Stay Safe

So, there you have it, folks. The Paycheck Protection Program warrant list might not be the most exciting topic, but it’s certainly an important one for small business owners. By understanding how it works and taking steps to stay compliant, you can protect your business and avoid unnecessary headaches.

Remember, if you ever find yourself in hot water, don’t hesitate to seek professional help. And if you’re not on the list (fingers crossed), keep up the good work. You’ve got this!

Now, here’s where you come in. Got questions or thoughts? Drop them in the comments below. And if you found this article helpful, don’t forget to share it with your fellow small business owners. Let’s keep the conversation going!

Table of Contents

- What Exactly is the Paycheck Protection Program?

- Why Should You Care About the PPP Warrant List?

- How Does the PPP Warrant List Work?

- Who Can End Up on the PPP Warrant List?

- How to Check If Your Business is on the PPP Warrant List

- What Happens If Your Business is on the Warrant List?

- Preventing Issues with the PPP Warrant List

- Real-Life Examples of PPP Warrant List Cases

- Conclusion: Stay Informed, Stay Safe

Article Recommendations