Tesla Stock Price History After Earnings: A Deep Dive Into The Numbers

Alright folks, let’s get real for a sec. Tesla stock price history after earnings has been nothing shorta wild ride. If you’ve been paying attention to the stock market, you know how Tesla has become this massive player that everyone’s talking about. It’s like the cool kid in school that everyone wants to hang out with—or invest in, in this case. Whether you’re a seasoned investor or just dipping your toes into the world of stocks, understanding Tesla’s price movements after earnings reports is crucial if you wanna make smart decisions.

Now, let me break it down for ya. Earnings season can feel like a rollercoaster ride for Tesla investors. One day, the stock’s flying high, and the next, it’s like, “Whoa, what happened?” But don’t panic! That’s why we’re here—to dissect the history of Tesla’s stock prices after earnings and figure out what’s really going on. Stick with me, and I’ll give you the lowdown on how Tesla’s stock behaves when those earnings reports drop.

Before we dive deeper, lemme remind ya that investing in Tesla—or any stock, for that matter—isn’t just about luck. It’s about doing your homework, understanding the numbers, and knowing what to expect. So, grab a cup of coffee, sit back, and let’s explore the fascinating world of Tesla stock price history after earnings. You ready? Let’s do this!

Read also:911 Lone Star Cast Everything You Need To Know About The Stars Of This Hit Tv Series

Here’s the table of contents to help you navigate through this bad boy:

- Biography of Tesla (The Company)

- How Earnings Impact Tesla Stock Prices

- Historical Trends in Tesla Stock Price After Earnings

- Key Metrics to Watch

- Market Sentiment and Tesla’s Stock

- Long-Term Outlook for Tesla Investors

- Common Mistakes to Avoid

- Expert Advice for Tesla Stock Investors

- Important Data Points to Consider

- Final Thoughts and Takeaways

Biography of Tesla (The Company)

Before we jump into the nitty-gritty of Tesla stock price history after earnings, let’s take a quick trip down memory lane. Tesla, Inc. was founded way back in 2003 by a group of engineers who had one bold mission: to accelerate the world’s transition to sustainable energy. Fast forward to today, and Tesla’s not just about making electric cars; it’s about revolutionizing the entire automotive industry and beyond.

Key Facts About Tesla

Here’s a quick rundown of some important details about Tesla:

| Founder | Elon Musk (though not the original founder, he played a pivotal role in shaping the company) |

|---|---|

| Headquarters | Austin, Texas, USA |

| Products | Electric vehicles (Model S, Model 3, Model X, Model Y), energy storage solutions (Powerwall, Powerpack), and solar products |

| Market Capitalization | Over $600 billion as of 2023 |

Now that we’ve got the basics covered, let’s move on to the juicy part: how earnings reports affect Tesla’s stock price.

How Earnings Impact Tesla Stock Prices

Earnings reports are basically the report cards of the corporate world. They tell you how much money a company made or lost during a specific period. For Tesla, these reports are huge deals because they give investors a glimpse into the company’s financial health and future prospects.

What Happens When Tesla Reports Earnings?

When Tesla releases its earnings, the stock price can go either way—up or down. It all depends on whether the company meets, beats, or misses analysts’ expectations. If Tesla crushes the numbers, the stock might soar. But if it falls short, well, let’s just say things can get bumpy.

Read also:What Is John Duttons Net Worth Exploring The Wealth Of A Tv Icon

For example, in Q2 2023, Tesla reported better-than-expected profits, and the stock jumped by over 5%. But in Q1 2022, when the company missed revenue targets, the stock took a hit, dropping by nearly 10%. See what I mean? It’s a rollercoaster!

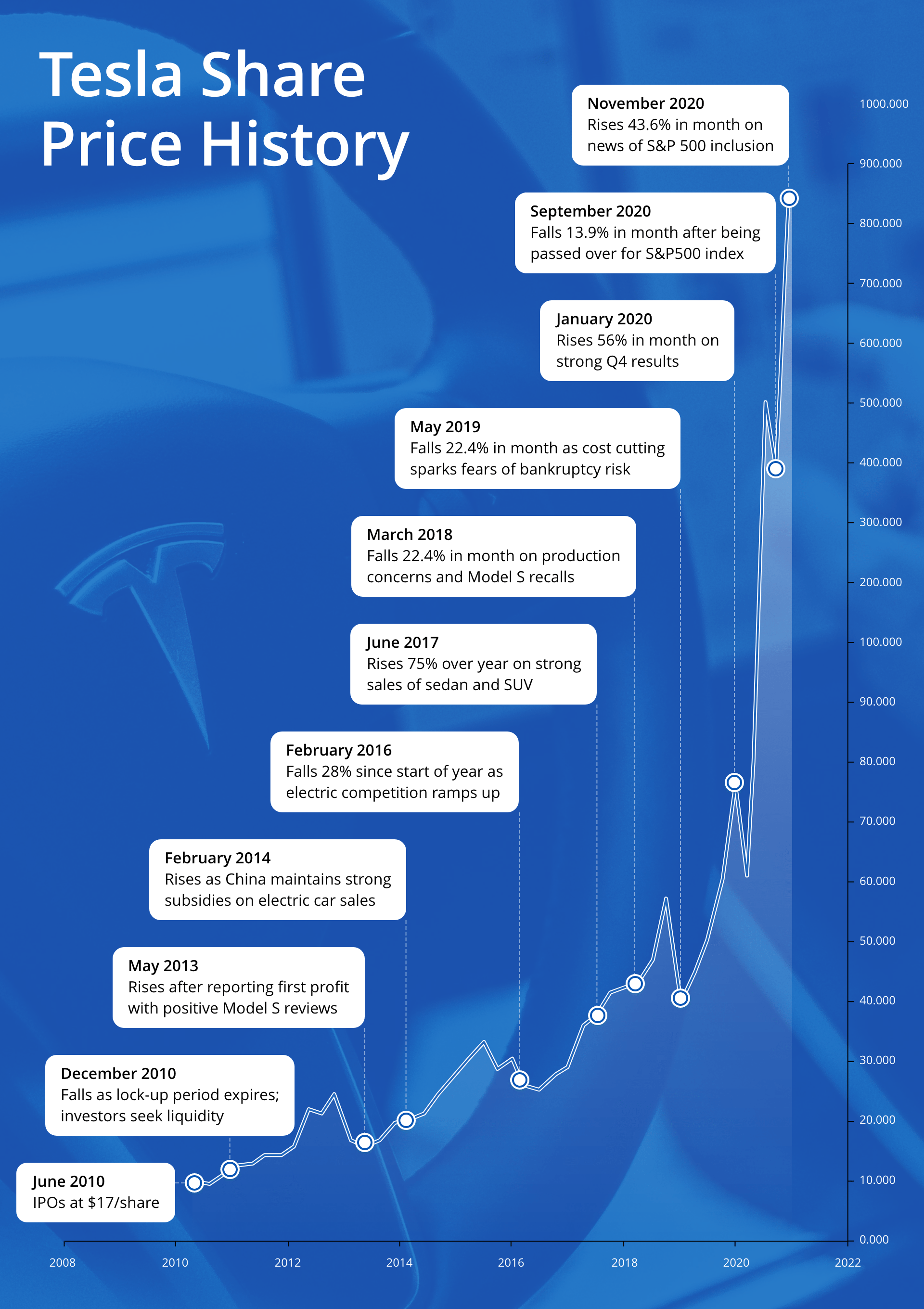

Historical Trends in Tesla Stock Price After Earnings

Now, let’s take a look at some historical trends in Tesla’s stock price after earnings. This is where the data gets really interesting. Over the past few years, we’ve seen some consistent patterns emerge.

Patterns to Watch For

- Volatility is Key: Tesla’s stock tends to be super volatile after earnings. Don’t be surprised if you see big swings in either direction.

- Positive Surprises Lead to Gains: When Tesla beats expectations, the stock often rallies. This has happened multiple times, proving that investors love good news.

- Negative Surprises Can Sting: On the flip side, when Tesla misses the mark, the stock can tank. It’s all about managing expectations.

Data from the past five years shows that Tesla’s stock has averaged a 5% move (up or down) after earnings. That’s a lot of movement, so buckle up if you’re planning to trade around these events.

Key Metrics to Watch

When analyzing Tesla’s stock price history after earnings, there are a few key metrics you should keep an eye on. These numbers can give you valuable insights into the company’s performance and how the market reacts.

Metrics That Matter

- Revenue Growth: Tesla’s revenue has been growing rapidly, and investors are always hungry for more. Watch for any signs of slowing growth.

- Profit Margins: As Tesla scales up production, its profit margins are crucial. Higher margins mean more profitability.

- Vehicle Deliveries: The number of cars Tesla delivers each quarter is a big deal. More deliveries usually mean more revenue.

These metrics are like the vital signs of Tesla’s business. If they’re strong, the stock is likely to perform well. If not, well, you know the drill.

Market Sentiment and Tesla’s Stock

Market sentiment plays a huge role in how Tesla’s stock behaves after earnings. When investors are feeling optimistic, they’re more likely to buy the stock, driving the price up. Conversely, if sentiment turns negative, selling pressure can push the stock down.

Factors Influencing Sentiment

- Global Economic Conditions: The overall state of the economy can affect investor sentiment. If the economy’s doing well, Tesla’s stock might benefit.

- Elon Musk’s Tweets: Love him or hate him, Elon’s social media activity can move markets. A single tweet can spark excitement—or panic.

- Competitive Landscape: How Tesla stacks up against rivals like Rivian and Lucid can also impact sentiment. If Tesla’s innovating faster, investors will notice.

Understanding market sentiment is like reading the tea leaves. It’s not an exact science, but it can give you a sense of where the stock might go.

Long-Term Outlook for Tesla Investors

So, what does the future hold for Tesla investors? While the short-term fluctuations can be wild, the long-term outlook looks promising. Tesla’s focus on innovation, sustainability, and global expansion positions it well for continued growth.

Why Tesla’s Future Looks Bright

- Global Demand for EVs: As more countries push for electric vehicles, Tesla is poised to benefit from increased demand.

- Energy Solutions: Tesla’s energy storage and solar products are becoming increasingly important as the world shifts to renewable energy.

- Brand Loyalty: Tesla has built a loyal customer base that’s passionate about the brand. This loyalty can drive sales and stock performance.

Of course, there are risks to consider, like competition and regulatory challenges. But overall, Tesla’s long-term prospects look solid.

Common Mistakes to Avoid

Investing in Tesla—or any stock—comes with risks. To help you avoid some common pitfalls, here are a few mistakes to steer clear of:

Avoid These Traps

- Chasing the Hype: Don’t get caught up in the hype and buy Tesla stock without doing your research. Emotional investing can lead to poor decisions.

- Ignoring the Fundamentals: Always look at the company’s financials and long-term strategy before making a move.

- Overreacting to Short-Term Moves: Stock price fluctuations after earnings are normal. Don’t panic if the stock drops; focus on the bigger picture.

By avoiding these mistakes, you’ll be better equipped to navigate the ups and downs of Tesla’s stock.

Expert Advice for Tesla Stock Investors

Now, let’s hear from the experts. Financial analysts and seasoned investors have some valuable insights to share when it comes to Tesla stock.

What the Experts Say

- Focus on the Long Game: Many experts advise taking a long-term view when investing in Tesla. The company’s vision and innovation are key drivers of its success.

- Stay Informed: Keep up with industry trends and Tesla’s developments. Knowledge is power in the stock market.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversifying your investments can help mitigate risk.

Listening to expert advice can provide valuable guidance, but always remember to do your own due diligence.

Important Data Points to Consider

Finally, let’s wrap up with some important data points to consider when analyzing Tesla’s stock price history after earnings:

- Tesla’s stock has averaged a 5% move after earnings over the past five years.

- The company has consistently delivered revenue growth, with Q2 2023 showing a 50% increase year-over-year.

- Elon Musk’s influence on the stock cannot be overstated. His tweets and public appearances often correlate with stock price movements.

These data points highlight the dynamic nature of Tesla’s stock and the factors that drive its performance.

Final Thoughts and Takeaways

Alright, we’ve covered a lot of ground here. To recap, Tesla’s stock price history after earnings is a fascinating study in volatility, innovation, and market sentiment. Understanding the key metrics, historical trends, and expert advice can help you make informed decisions as a Tesla investor.

So, what’s next? If you’re considering investing in Tesla, take the time to do your research and assess whether it aligns with your financial goals. And remember, the stock market is unpredictable, so always be prepared for the unexpected.

Now, it’s your turn. Share your thoughts in the comments below. Have you invested in Tesla? What’s been your experience? And if you found this article helpful, don’t forget to share it with your friends. Together, we can keep the conversation going. Happy investing, folks! 🚀

Article Recommendations