JCPenney Charge Card Application: The Ultimate Guide For Smart Shoppers

Are you ready to unlock the power of shopping with ease and convenience? JCPenney charge card application is your gateway to exclusive deals, rewards, and a hassle-free shopping experience. Whether you're a loyal JCPenney customer or just starting your journey with this iconic brand, this card could be your ultimate shopping companion. So, buckle up as we dive deep into everything you need to know about the JCPenney charge card application!

Let’s face it, in today’s world, having the right credit card can make all the difference. Imagine walking into your favorite store, picking out that perfect outfit or home decor, and knowing you’re getting it at a discount. That’s exactly what the JCPenney charge card offers. But hold up, before you jump in, there’s a lot you need to know about the application process, benefits, and more.

Think of this article as your personal shopping advisor. We’ll break down the ins and outs of the JCPenney charge card application, so you can make an informed decision. Whether you’re wondering about the application steps, eligibility criteria, or the perks of owning this card, we’ve got you covered. Let’s get started!

Read also:Nick Cannon Parents Unveiling The Family Behind The Star

Here’s a quick roadmap to help you navigate through this guide:

- What is JCPenney Charge Card?

- Eligibility Criteria

- Application Process

- Benefits of the JCPenney Charge Card

- Rewards and Discounts

- Fees and Interest Rates

- Tips for a Successful Application

- Common Questions About the Card

- Alternatives to JCPenney Charge Card

- Conclusion

What is JCPenney Charge Card?

Alright, let’s start with the basics. The JCPenney charge card is more than just a piece of plastic; it’s your ticket to exclusive savings and rewards at JCPenney stores. This card allows you to make purchases at JCPenney and enjoy benefits like special discounts, deferred interest offers, and cashback rewards.

Why Choose the JCPenney Charge Card?

Here’s the deal—this card isn’t just about convenience. It’s about maximizing your shopping experience. Whether you’re buying clothes, furniture, or electronics, the JCPenney charge card can help you save money while earning rewards. Plus, it’s super easy to apply for, and the approval process is quick.

Eligibility Criteria for JCPenney Charge Card

Now, let’s talk about who can apply for this card. The eligibility criteria are pretty straightforward, but it’s important to know what the card issuer is looking for. Typically, you’ll need:

- A stable source of income

- A good credit score (though not always required)

- A valid social security number

- Proof of address

Don’t worry if your credit score isn’t perfect. JCPenney offers both charge cards and credit cards, so there’s something for everyone. Just remember, the better your credit score, the better terms you might get.

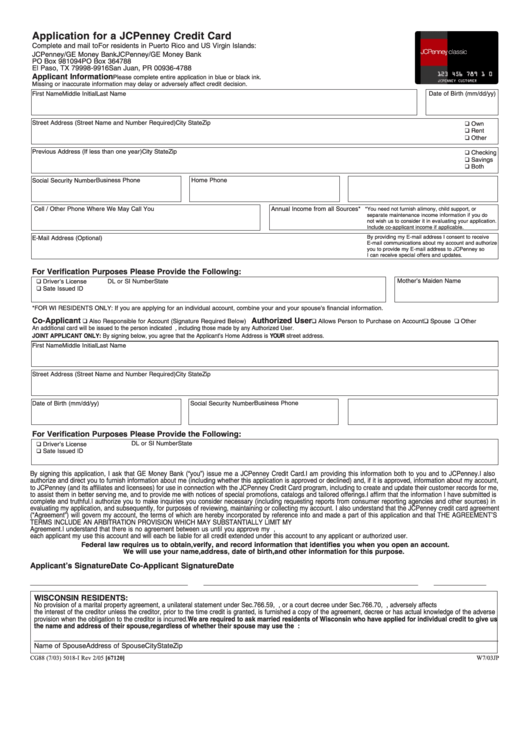

Application Process for JCPenney Charge Card

Applying for the JCPenney charge card is a breeze. You can do it online, in-store, or over the phone. Let’s break it down:

Read also:Shelly Long The Iconic Journey Of A Legendary Actress

Step 1: Gather Your Documents

Before you start, make sure you have the following ready:

- Driver’s license or state ID

- Social security card

- Proof of income (pay stubs or bank statements)

Step 2: Choose Your Application Method

Here’s how you can apply:

Online Application: Head over to the JCPenney website, fill out the form, and submit. It’s quick and easy!

In-Store Application: Visit your nearest JCPenney store, speak to a representative, and they’ll guide you through the process.

Phone Application: Call the customer service number and apply over the phone. They’ll walk you through each step.

Benefits of the JCPenney Charge Card

So, why should you consider getting the JCPenney charge card? Let’s talk benefits:

- Exclusive Discounts: Enjoy special offers and discounts on your purchases.

- Deferred Interest: Take advantage of interest-free periods on certain purchases.

- No Annual Fee: Yes, you heard that right. There’s no annual fee for this card.

- Flexible Payment Options: Pay off your balance in manageable installments.

These perks make the JCPenney charge card a smart choice for anyone looking to save money while shopping.

Rewards and Discounts

Let’s talk about the sweet stuff—rewards and discounts. As a cardholder, you’ll have access to:

- Exclusive coupons and promo codes

- Special event invitations

- Cashback rewards on select purchases

- Price adjustments on items that go on sale

It’s like having your own personal shopper who’s always looking out for deals.

How Do Rewards Work?

Rewards are typically based on your spending. The more you use your card, the more rewards you earn. You can redeem these rewards for discounts, gift cards, or even cashback. It’s a win-win situation!

Fees and Interest Rates

While the JCPenney charge card offers plenty of benefits, it’s important to understand the fees and interest rates. Here’s what you need to know:

- No Annual Fee: Again, this card doesn’t charge an annual fee.

- Interest Rates: Vary based on your creditworthiness, but they’re competitive.

- Late Payment Fee: Be sure to pay your bill on time to avoid this fee.

Always review the terms and conditions before applying to ensure you’re comfortable with the fees and rates.

Tips for a Successful Application

Ready to apply? Here are some tips to increase your chances of approval:

- Check your credit score beforehand

- Provide accurate and complete information

- Be honest about your income and expenses

- Apply during a promotional period for better terms

Remember, the more prepared you are, the smoother the application process will be.

Common Questions About the JCPenney Charge Card

Let’s address some frequently asked questions:

Q: Can I use the JCPenney charge card anywhere?

A: Nope, this card is specifically designed for use at JCPenney stores and their online platform.

Q: What happens if I miss a payment?

A: You might incur a late fee and it could impact your credit score. Always aim to pay on time.

Q: Is there a limit on how much I can spend?

A: Yes, your spending limit will depend on your creditworthiness and payment history.

Alternatives to JCPenney Charge Card

If the JCPenney charge card isn’t the right fit for you, there are other options. Consider:

- Store-specific credit cards from other retailers

- General-purpose credit cards with retail rewards

- Debit cards with cashback options

Do your research and choose the option that aligns best with your shopping habits and financial goals.

Conclusion

There you have it, the ultimate guide to the JCPenney charge card application. Whether you’re a seasoned shopper or just starting out, this card could be a game-changer for your shopping experience. Remember, the key is to use it wisely and take advantage of all the benefits it offers.

So, what are you waiting for? Head over to JCPenney and apply for your charge card today. And don’t forget to share this article with your friends and family who might find it helpful. Happy shopping!

Article Recommendations