ADP W2 Availability: A Comprehensive Guide For Employees

Have you ever wondered when your ADP W2 form will be available and how to access it? Well, let me break it down for you. The ADP W2 availability is something that every employee needs to pay attention to because it plays a huge role in your tax filing process. Whether you're a seasoned pro at filing taxes or a complete newbie, understanding the ADP W2 timeline can save you a lot of headaches. So, buckle up, and let's dive into everything you need to know.

First things first, the ADP W2 form is like your ticket to filing your annual taxes correctly. Without it, you're basically flying blind in the world of IRS forms and deductions. The availability of this form usually depends on your employer's schedule, but there are some general timelines that most companies follow. We'll get into all the juicy details shortly, but for now, just know that staying informed is key.

Now, if you're one of those people who starts stressing out about taxes as soon as January rolls around, don't worry, you're not alone. The good news is, with ADP's system, accessing your W2 form has never been easier. You just need to know when to expect it and where to find it. So, whether you're a tech-savvy millennial or someone who still prefers paper copies, we've got you covered. Let's jump into the nitty-gritty of ADP W2 availability.

Read also:Funko Pop Mash The Ultimate Guide To Collectible Crossovers

Understanding the Basics of ADP W2 Availability

Alright, before we dive deep into the specifics, let's talk about what exactly ADP W2 availability means. In a nutshell, it refers to the time when your employer makes your W2 form accessible through the ADP system. This is usually done electronically, but some employers still offer paper copies if you prefer that route. The key here is timing, and understanding the timeline can make all the difference in your tax preparation journey.

Now, let's break it down even further. The IRS requires employers to send out W2 forms by January 31st each year. However, the actual ADP W2 availability might vary depending on your employer's processing time. Some companies might release it earlier, while others might wait until the deadline. Either way, being proactive and checking with your HR department can help you stay ahead of the game.

Why ADP W2 Availability Matters for Tax Filing

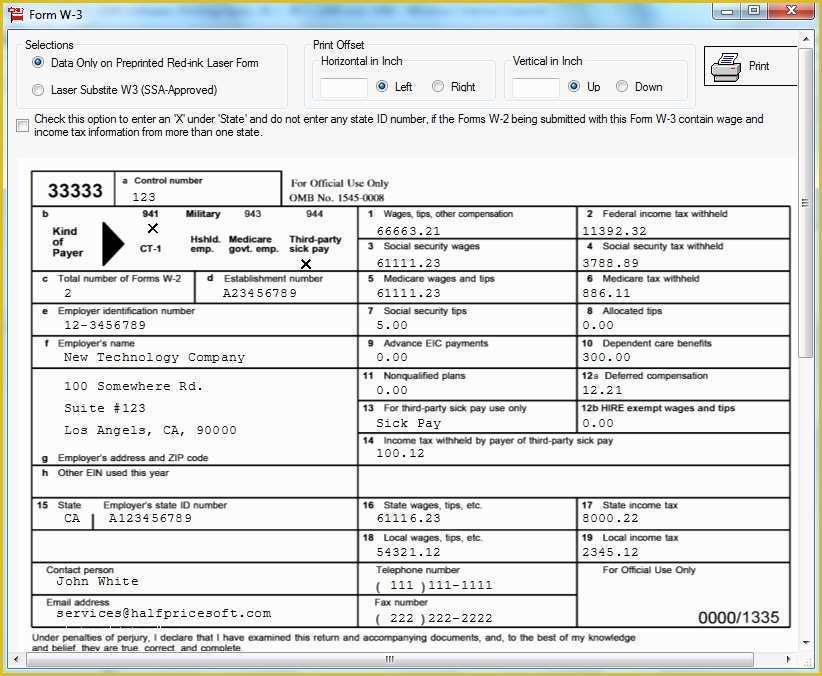

Here's the deal: your ADP W2 form contains all the essential information you need to file your taxes accurately. It includes details like your total earnings, federal and state taxes withheld, and other important figures that affect your tax return. Without this information, you're essentially shooting in the dark when it comes to filing your taxes.

For example, if you're expecting a tax refund, having your ADP W2 form early can help you file sooner and potentially get your refund faster. On the flip side, if you owe money to the IRS, getting your W2 form on time can help you plan and avoid late penalties. So, whether you're looking forward to a refund or bracing for a payment, knowing when your ADP W2 is available is crucial.

Key Factors Affecting ADP W2 Availability

There are several factors that can influence when your ADP W2 form becomes available. One of the biggest factors is your employer's processing timeline. Larger companies with more employees might take a bit longer to process all the forms, while smaller companies might finish earlier. Additionally, any technical issues with the ADP system or delays in data entry can also impact the availability of your W2 form.

Another factor to consider is the method of delivery. If your employer offers both electronic and paper copies, the electronic version is usually available sooner. However, if you opt for a paper copy, it might take a bit longer to arrive in the mail. So, if you're someone who prefers instant access, going digital might be the way to go.

Read also:Who Is The Lululemon Founder Unveiling The Visionary Behind The Brand

How to Check ADP W2 Availability

Checking your ADP W2 availability is easier than you might think. Most employers use the ADP system to provide employees with access to their W2 forms online. All you need is your login credentials and a few clicks, and voila! You're on your way to accessing your form.

Here's a quick step-by-step guide to help you check your ADP W2 availability:

- Log in to your ADP account using your username and password.

- Once logged in, navigate to the "Employee Self-Service" section.

- From there, look for the "Tax Documents" or "W2" option in the menu.

- If your W2 form is available, you should be able to view and download it as a PDF.

Simple, right? And if you ever run into any issues, most ADP systems have a helpdesk or customer support team ready to assist you.

Troubleshooting Common Issues with ADP W2 Availability

Let's face it, sometimes things don't go as smoothly as we'd like. If you're having trouble accessing your ADP W2 form, don't panic. There are a few common issues that might be causing the problem, and most of them have easy fixes.

One common issue is forgetting your login credentials. If this happens, most ADP systems have a "Forgot Password" option that allows you to reset your password. Another issue could be technical glitches on the ADP system itself. In this case, patience is key. Try accessing the system at a different time or contact your HR department for assistance.

ADP W2 Availability Timeline: What to Expect

Now, let's talk about the timeline you can expect for ADP W2 availability. As mentioned earlier, the IRS requires employers to send out W2 forms by January 31st. However, the actual availability in the ADP system might vary slightly. Most companies aim to have the forms available by mid-January, but some might take a bit longer.

Here's a rough timeline to give you an idea:

- Early January: Some employers begin processing W2 forms.

- Mid-January: Many employers make W2 forms available through the ADP system.

- January 31st: Deadline for employers to send out W2 forms.

Of course, every employer is different, so it's always a good idea to check with your HR department for specific timelines.

Benefits of Electronic ADP W2 Availability

Let's be real, in today's digital age, having access to your ADP W2 form electronically is a game-changer. Not only is it faster and more convenient, but it also reduces the risk of losing important documents. Plus, with electronic copies, you can easily save and organize your W2 forms for future reference.

Here are a few benefits of electronic ADP W2 availability:

- Instant access: No need to wait for paper copies in the mail.

- Secure storage: You can save your W2 form in a secure digital location.

- Easy sharing: Need to send your W2 form to your accountant? Just attach the PDF and you're good to go.

So, if your employer offers electronic W2 forms, it's definitely worth taking advantage of this option.

Security Measures for Accessing ADP W2 Forms

Now, before you start accessing your ADP W2 form online, it's important to ensure that your information is secure. ADP uses various security measures to protect your data, but there are also steps you can take to safeguard your account.

First, make sure you're using a strong and unique password for your ADP account. Avoid using easily guessable information like your birthdate or common words. Additionally, always log out of your account after accessing your W2 form, especially if you're using a public computer. And if you ever suspect unauthorized access, report it to your HR department immediately.

What to Do If Your ADP W2 Form Is Delayed

Sometimes, despite everyone's best efforts, your ADP W2 form might be delayed. If this happens, don't panic. There are steps you can take to address the issue and ensure you get your form as soon as possible.

First, reach out to your HR department. They might be able to provide you with an update on the status of your W2 form. If your employer is unable to resolve the issue, you can also contact the IRS for assistance. The IRS has a special hotline for W2-related issues, and they can guide you through the process of filing your taxes without the form if necessary.

IRS Resources for W2 Issues

If you're dealing with a delayed W2 form, the IRS has several resources available to help you. For starters, you can use Form 4852, the Substitute for Form W-2, to file your taxes without your actual W2 form. This form allows you to estimate your income and tax withholdings based on your last pay stub or other records.

Additionally, the IRS website offers a wealth of information on W2-related issues, including FAQs and contact information for their support team. So, if you ever find yourself in a bind, don't hesitate to reach out for help.

Final Thoughts on ADP W2 Availability

Alright, we've covered a lot of ground here, from understanding the basics of ADP W2 availability to troubleshooting common issues and exploring the benefits of electronic access. The bottom line is, staying informed and proactive is key to ensuring a smooth tax filing process.

So, whether you're checking your ADP W2 availability online or reaching out to your HR department for updates, taking control of your tax preparation can save you a lot of stress and hassle. And remember, if you ever run into any issues, don't hesitate to seek help from your employer or the IRS.

Now, it's your turn. Did we miss anything important? Have you experienced any challenges with ADP W2 availability that we didn't cover? Let us know in the comments below, and feel free to share this article with your colleagues or friends who might find it helpful. Together, we can make tax season a little less stressful for everyone!

Table of Contents

- Understanding the Basics of ADP W2 Availability

- Why ADP W2 Availability Matters for Tax Filing

- Key Factors Affecting ADP W2 Availability

- How to Check ADP W2 Availability

- Troubleshooting Common Issues with ADP W2 Availability

- ADP W2 Availability Timeline: What to Expect

- Benefits of Electronic ADP W2 Availability

- Security Measures for Accessing ADP W2 Forms

- What to Do If Your ADP W2 Form Is Delayed

- IRS Resources for W2 Issues

Article Recommendations