Boost Your Finances: Mastering BB&T Login Mobile Banking

Hey there, finance savvy friend! Let's dive straight into the nitty-gritty of modern-day banking, because let's be honest, who doesn't love convenience? If you've been searching for the ultimate guide to BB&T login mobile banking, you're in the right place. Mobile banking has become the go-to solution for managing your finances on the go, and BB&T is leading the pack with its user-friendly platform. So, buckle up as we explore how this tool can transform the way you handle your money.

Nowadays, having access to your bank account at your fingertips is more than just a luxury—it's a necessity. Whether you're paying bills, transferring funds, or checking your balance, BB&T mobile banking makes life easier. But let's not forget, with great power comes great responsibility. Knowing how to securely log in and navigate the app is key to making the most out of this service. Stick around, and we'll break it down step by step for you.

Before we dive deeper, let's address the elephant in the room. Mobile banking isn't just about convenience; it's also about security. With cyber threats lurking around every corner, understanding how BB&T safeguards your information is crucial. We'll cover everything from setting up two-factor authentication to recognizing phishing attempts. By the end of this guide, you'll be a pro at navigating the BB&T mobile banking app with confidence. Let's get started!

Read also:Dave Grohl The Drummer Who Rocked Nirvana

Understanding BB&T Mobile Banking: Your Gateway to Financial Freedom

Alright, let's get into the meat of the matter. BB&T mobile banking isn't just another app; it's a game-changer in the world of personal finance. With features ranging from bill payments to investment tracking, this platform offers a comprehensive suite of tools designed to simplify your financial life. Whether you're a tech-savvy millennial or someone who's just dipping their toes into the digital banking world, BB&T has something for everyone.

One of the standout features of BB&T mobile banking is its ease of use. The app is designed with the user in mind, ensuring that even the most complex transactions can be completed with just a few taps. Plus, the sleek interface makes navigating through various functions a breeze. But don't just take our word for it; countless users have raved about how this app has transformed the way they manage their finances.

So, why should you choose BB&T mobile banking over other options? For starters, it's backed by one of the most trusted names in banking. With a reputation for reliability and customer service, BB&T ensures that your financial needs are met with the utmost care. Additionally, the app offers features like real-time alerts, which keep you informed about your account activity, helping you stay on top of your game.

Step-by-Step Guide to BB&T Login Mobile Banking

Now that we've covered the basics, let's walk you through the process of logging in to BB&T mobile banking. It's simpler than you think, and with a little guidance, you'll be up and running in no time.

- First things first, download the BB&T mobile app from either the Apple App Store or Google Play Store. Make sure you're downloading the official app to avoid any security risks.

- Once the app is installed, open it and tap on the 'Login' button. You'll be prompted to enter your username and password. If you're a first-time user, you'll need to set up your credentials.

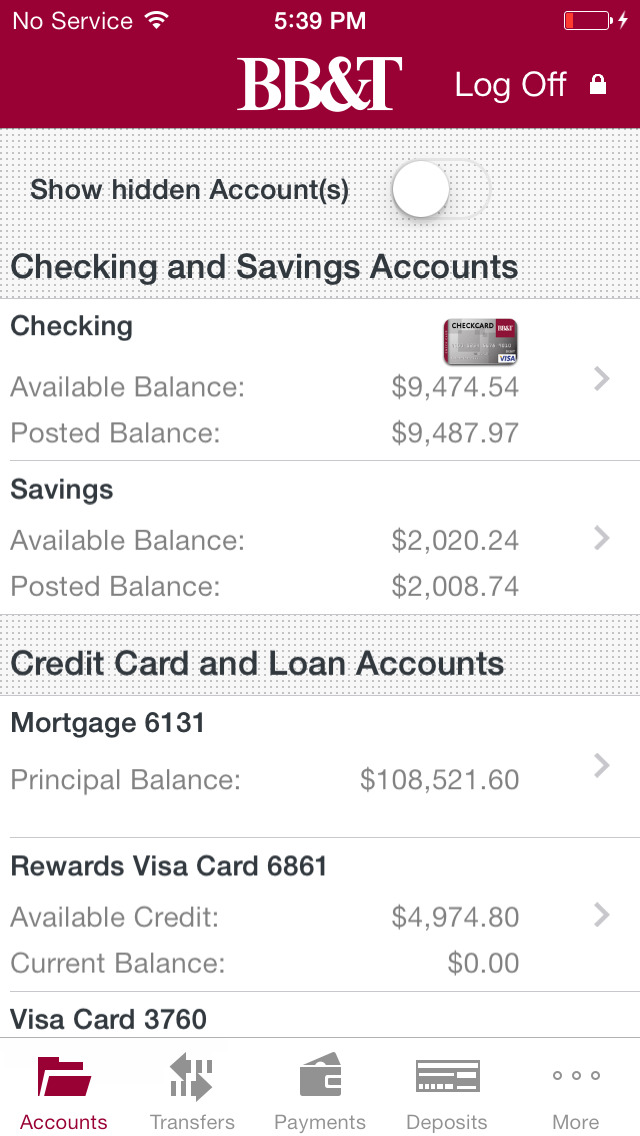

- After logging in, you'll be taken to the main dashboard, where you can access all the features of the app. From here, you can check your account balances, pay bills, and more.

Pro tip: Always ensure that you're using a secure network when logging in to your BB&T account. Public Wi-Fi might seem convenient, but it's not the safest option when it comes to protecting your sensitive information.

Security Features: How BB&T Keeps Your Data Safe

Security is a top priority when it comes to mobile banking, and BB&T doesn't skimp on this front. The app is equipped with several layers of protection to ensure that your data remains safe from prying eyes. Let's take a look at some of the key security features that make BB&T mobile banking a trustworthy choice.

Read also:Unveiling The Secrets Of Seal Team The Ultimate Tv Show For Military Buffs

First up, we have two-factor authentication (2FA). This feature adds an extra layer of security by requiring a second form of verification in addition to your password. Whether it's a one-time code sent to your phone or a fingerprint scan, 2FA makes it significantly harder for unauthorized users to access your account.

Another important feature is the ability to set up transaction alerts. These alerts notify you whenever there's activity in your account, allowing you to quickly identify and address any suspicious transactions. Plus, BB&T employs state-of-the-art encryption technology to protect your data while it's being transmitted.

Common Issues and Troubleshooting Tips

Even the best apps can encounter hiccups from time to time. If you're experiencing issues with your BB&T mobile banking login, don't panic. Here are a few common problems and how to fix them:

- Forgot Password: If you've forgotten your password, don't worry. Simply tap on the 'Forgot Password' option and follow the instructions to reset it. You'll receive a verification code via email or text, which you can use to create a new password.

- Login Issues: If you're having trouble logging in, double-check your username and password. It's also a good idea to ensure that your app is up to date. Outdated software can sometimes cause login issues.

- App Crashes: If the app keeps crashing, try clearing the cache and restarting your device. If the problem persists, consider uninstalling and reinstalling the app.

Still stuck? BB&T's customer support team is always ready to assist you. Whether it's a simple question or a more complex issue, they're just a phone call away.

Exploring the Features of BB&T Mobile Banking

Now that you're logged in and secure, it's time to explore all the amazing features that BB&T mobile banking has to offer. From bill payments to investment tracking, this app has everything you need to take control of your finances.

Bill Payments Made Easy

Gone are the days of writing checks and waiting for them to clear. With BB&T mobile banking, you can pay all your bills with just a few taps. Simply add your payees, schedule payments, and let the app handle the rest. Plus, you can set up automatic payments to ensure that you never miss a deadline.

Account Transfers: Seamless and Secure

Need to transfer funds between accounts? BB&T mobile banking makes it effortless. Whether you're moving money between your checking and savings accounts or sending funds to a friend, the process is quick and secure. You can even set up recurring transfers to streamline your financial management.

Benefits of Using BB&T Mobile Banking

So, what makes BB&T mobile banking stand out from the crowd? Here are a few reasons why this app deserves a spot on your smartphone:

- Convenience: With BB&T mobile banking, you can access your accounts anytime, anywhere. No more trips to the branch or waiting in line for customer service.

- Security: As we've already discussed, BB&T takes security seriously. With features like 2FA and transaction alerts, you can rest assured that your data is safe.

- Comprehensive Features: From bill payments to investment tracking, BB&T mobile banking offers a wide range of tools to help you manage your finances.

Plus, the app is constantly being updated with new features and improvements, ensuring that it stays ahead of the curve.

Comparing BB&T Mobile Banking to Other Platforms

Of course, BB&T isn't the only game in town when it comes to mobile banking. So, how does it stack up against the competition? Let's take a look at some of the key differences:

BB&T vs. Other Banks

While many banks offer similar features, BB&T stands out with its user-friendly interface and robust security measures. Plus, the app's performance is consistently praised by users, with few reports of crashes or glitches.

BB&T vs. Fintech Apps

Compared to fintech apps like Venmo or PayPal, BB&T mobile banking offers a more comprehensive suite of tools. While these apps are great for peer-to-peer payments, they don't provide the same level of financial management features as BB&T.

Customer Reviews: What Users Are Saying

Don't just take our word for it; let's hear from the people who matter most—BB&T users. Reviews across various platforms consistently highlight the app's ease of use, security features, and reliability. Many users appreciate the ability to manage multiple accounts from one place and the convenience of mobile check deposits.

Of course, no app is perfect, and some users have reported occasional glitches or slow load times. However, these issues are relatively rare and are usually resolved quickly by BB&T's support team.

Future Updates and Enhancements

As technology continues to evolve, so does BB&T mobile banking. The development team is always working on new features and improvements to make the app even better. Some of the upcoming updates include enhanced biometric login options, improved budgeting tools, and more personalized investment advice.

Stay tuned for these exciting developments and keep checking the app store for updates to ensure you're always using the latest version of BB&T mobile banking.

Conclusion: Take Control of Your Finances Today

And there you have it, folks—a comprehensive guide to mastering BB&T login mobile banking. Whether you're a seasoned pro or a first-time user, this app has everything you need to take control of your finances. From its user-friendly interface to its robust security features, BB&T mobile banking is a must-have tool for anyone looking to simplify their financial life.

So, what are you waiting for? Download the app today and start exploring all the amazing features it has to offer. And don't forget to share your thoughts in the comments below. We'd love to hear how BB&T mobile banking has transformed the way you manage your money.

Table of Contents

Article Recommendations