Dave Ramsey 401k Investing: A Straightforward Guide To Securing Your Financial Future

Hey there, friend! Let’s talk about something that’s as important as it is misunderstood—investing in your 401k, especially through the lens of Dave Ramsey’s trusted financial advice. You’ve probably heard about Dave Ramsey and his no-nonsense approach to personal finance. Well, today we’re diving deep into how Dave Ramsey’s principles can transform the way you think about 401k investing. This is not just another boring finance article; it’s your roadmap to financial freedom. So grab your coffee, sit tight, and let’s get started!

Now, why are we even talking about 401k investing? Because it’s one of the most powerful tools at your disposal when it comes to building wealth for retirement. And let’s face it, retirement might feel like a distant dream right now, but trust me, the earlier you start planning, the better off you’ll be. Dave Ramsey’s strategies are designed to help you navigate this often-confusing world of investments with confidence. It’s time to take charge of your financial future!

Before we dive into the nitty-gritty, let’s set the stage. Dave Ramsey’s philosophy revolves around simplicity, discipline, and long-term thinking. These principles are crucial when it comes to making smart decisions about your 401k. Whether you’re just starting out or looking to fine-tune your existing plan, this article has got you covered. Let’s make sure you’re not leaving money on the table—or worse, losing it because of bad choices.

Read also:Bridgerton Exploring The Phenomenon And The Brilliance Of Kuang

Who Is Dave Ramsey?

Let’s rewind a bit and get to know the man behind the message. Dave Ramsey is more than just a financial guru; he’s a beacon of hope for millions of people struggling to get their finances in order. Through his best-selling books, podcasts, and live events, Dave has helped countless individuals achieve financial peace. But who exactly is this guy, and why should you listen to him?

Here’s a quick snapshot:

Biography of Dave Ramsey

Dave Ramsey started his journey in the world of finance after losing everything in a real estate crash. This personal experience taught him invaluable lessons about money management, which he later turned into a thriving career helping others avoid the same mistakes. Today, Dave is a household name in personal finance, known for his straightforward advice and compassionate approach.

| Full Name | Dave Ramsey |

|---|---|

| Birth Date | September 2, 1960 |

| Profession | Financial Author, Speaker, and Radio Host |

| Books | Total Money Makeover, Smart Money Smart Kids, and more |

| Net Worth | Estimated $100 million+ |

What Is a 401k?

Alright, let’s break it down. A 401k is essentially a retirement savings plan offered by employers. It allows you to contribute a portion of your paycheck directly into an investment account before taxes are taken out. Over time, these contributions grow, thanks to the magic of compound interest. Sounds pretty sweet, right? But here’s the catch—many people don’t fully understand how to maximize their 401k’s potential. That’s where Dave Ramsey comes in.

Why Trust Dave Ramsey’s 401k Advice?

Dave Ramsey’s approach to 401k investing is rooted in his broader philosophy of financial stewardship. He emphasizes the importance of paying yourself first, avoiding debt, and making wise investment choices. These principles align perfectly with the goals of a 401k plan. By following Dave’s advice, you can ensure that your retirement savings are working as hard as possible for you.

Key Principles of Dave Ramsey’s 401k Strategy

Start Early

The earlier you start contributing to your 401k, the more time your money has to grow. This is one of Dave’s core messages. Even small contributions made consistently over time can lead to significant wealth accumulation. Don’t wait until you’re older or earning more—start now!

Read also:Unveiling The Magic Of Age Of Wonders 4 A Comprehensive Guide

Take Advantage of Employer Matching

Many employers offer a matching contribution for your 401k. This is essentially free money, and Dave strongly advises taking full advantage of it. If your employer matches up to 3% of your salary, aim to contribute at least that much. Leaving matching contributions on the table is like throwing away cash.

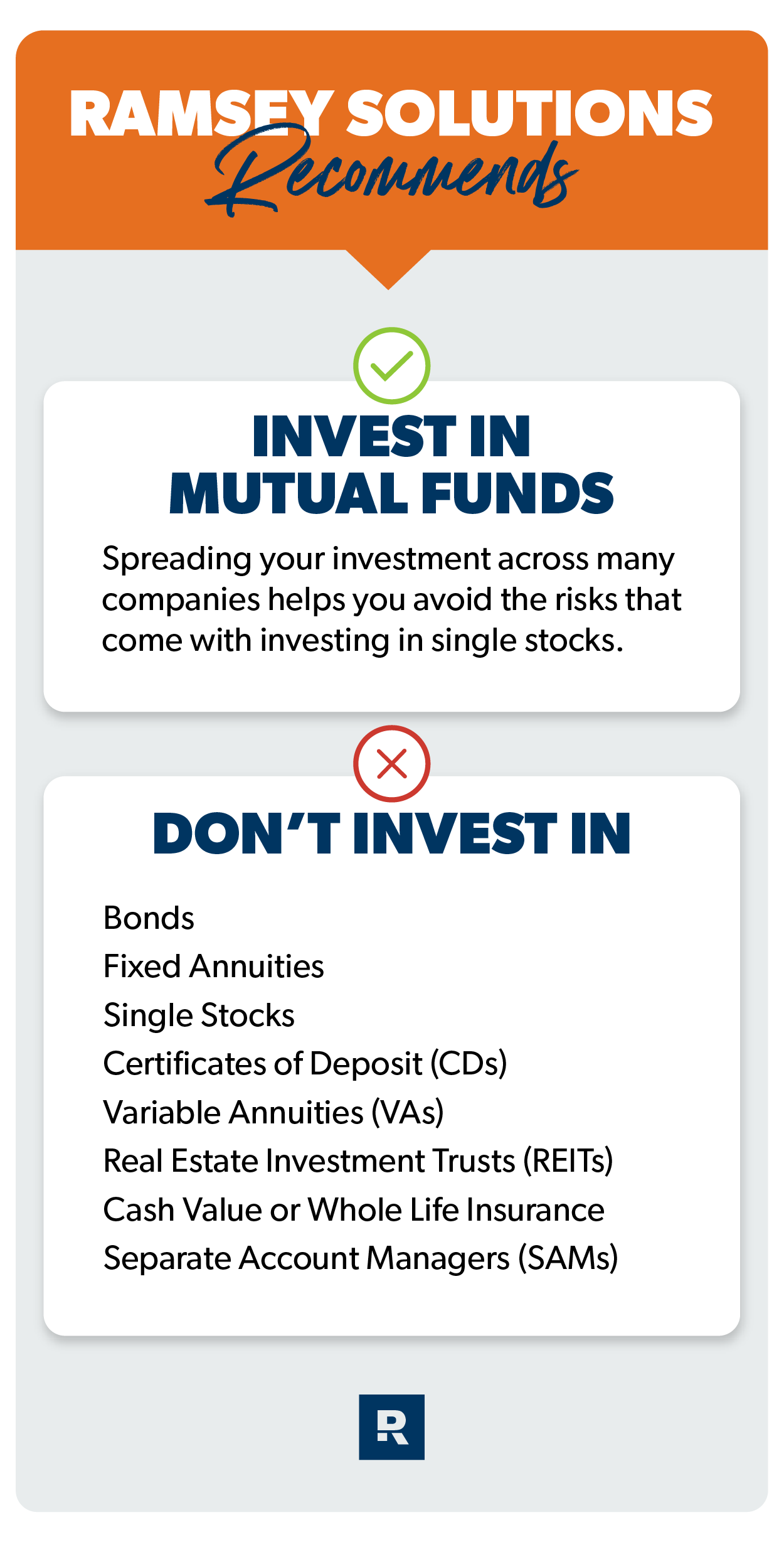

Choose the Right Funds

When it comes to selecting investment options within your 401k, Dave recommends focusing on growth stock mutual funds. These funds have historically outperformed other types of investments over the long term. Look for funds with a proven track record and low expense ratios.

Avoid Emotional Decisions

Investing can be emotional, especially when the market fluctuates. Dave advises staying the course and avoiding knee-jerk reactions to short-term market changes. Remember, your 401k is a long-term investment. Stick to your plan, and you’ll come out ahead.

Common Mistakes to Avoid

Even with the best intentions, people often make mistakes when managing their 401k. Here are a few common pitfalls to watch out for:

- Not contributing enough to get the full employer match

- Choosing the wrong investment options

- Cashing out your 401k early

- Letting emotions drive investment decisions

How Much Should You Contribute?

According to Dave Ramsey, you should aim to save 15% of your income for retirement. This includes both your 401k contributions and any other retirement savings accounts you might have. While this may seem like a lot, remember that your future self will thank you for it. Plus, the tax benefits of a 401k make it easier to reach this goal than you might think.

The Power of Compound Interest

Compound interest is the secret sauce of 401k investing. It’s the process by which your investments earn returns, and those returns then earn additional returns over time. The longer your money stays invested, the greater the impact of compound interest. Dave Ramsey often uses the analogy of planting seeds—your early contributions are the seeds that grow into a lush garden of financial security.

When Should You Withdraw?

Retirement might seem far away, but eventually, you’ll want to access the money you’ve saved in your 401k. Dave advises waiting until you’re at least 59½ years old to avoid penalties. Additionally, he suggests having a solid retirement plan in place before withdrawing any funds. This ensures that your money lasts as long as you need it.

Real-Life Success Stories

One of the best parts about following Dave Ramsey’s advice is seeing real people achieve financial success. Take John, for example. John started contributing to his 401k in his early 30s and followed Dave’s principles of consistent contributions and smart fund selection. By the time he reached retirement age, his 401k had grown to over a million dollars. Stories like John’s are proof that Dave’s strategies work.

Resources to Learn More

If you’re eager to dive deeper into Dave Ramsey’s 401k investing strategies, here are a few resources to check out:

- Dave Ramsey’s Official Website

- The Total Money Makeover by Dave Ramsey

- Smart Money Smart Kids by Dave Ramsey

Conclusion

There you have it, folks—a comprehensive guide to Dave Ramsey’s 401k investing strategies. By starting early, taking advantage of employer matching, choosing the right funds, and avoiding emotional decisions, you can set yourself up for a secure financial future. Remember, the key to success is consistency and discipline. So, what are you waiting for? Start implementing these strategies today and watch your 401k grow.

Before you go, I’d love to hear from you. Have you tried any of Dave Ramsey’s methods for 401k investing? What challenges have you faced, and how are you overcoming them? Drop a comment below and share your thoughts. And don’t forget to share this article with your friends and family who could benefit from it. Together, we can build a brighter financial future!

Table of Contents

Article Recommendations