Fraud PPP Loan List: The Shocking Truth Behind The Numbers

When it comes to fraud PPP loan list, the story is more than just numbers and headlines. It's about trust, accountability, and the billions of dollars meant to save small businesses during a global crisis. But what happens when that trust is broken? Let's dive into the nitty-gritty and uncover the truth behind the biggest scandal you might not have heard enough about.

Picture this: a pandemic hits, businesses shut down overnight, and millions of people lose their jobs. The government steps in with the Paycheck Protection Program (PPP) to help small businesses stay afloat. Sounds great, right? But here's the twist—some folks saw this as an opportunity to line their own pockets. Yep, we're talking about the fraud PPP loan list, where individuals and companies exploited the system for personal gain.

Now, I’m not here to judge or point fingers, but this is serious business. We’re talking about taxpayer money being misused, and that affects everyone. So, buckle up because we’re about to explore the ins and outs of this scandal, from how it happened to what’s being done about it. Trust me, it's gonna be a wild ride.

Read also:Isabel May Discovering The Current Partner And Personal Journey

What is the PPP Program Anyway?

Before we deep-dive into the fraud PPP loan list, let’s back up a bit and talk about what the PPP program actually is. Launched in April 2020 as part of the CARES Act, the PPP aimed to provide financial relief to small businesses impacted by the pandemic. Businesses could apply for forgivable loans if they used the funds to cover payroll, rent, utilities, and other eligible expenses.

Here’s the kicker: the loans were designed to be forgiven if certain conditions were met. That means businesses could essentially get free money to keep their employees on the payroll and avoid layoffs. Sounds like a win-win, right? Well, not exactly. The program’s rapid rollout and lack of oversight created the perfect storm for fraudsters to strike.

Did you know? The Small Business Administration (SBA) approved over 11 million PPP loans, totaling more than $800 billion. And while most of that money went to legitimate businesses, a significant portion ended up in the wrong hands. Let’s break it down.

How Did Fraud Happen in the PPP Program?

Now, here’s where things get interesting. The PPP program was designed to be fast and flexible, which unfortunately opened the door for fraud. With minimal documentation requirements and a focus on speed, it became easier for scammers to exploit the system. Here are some of the most common tactics used:

- Submitting fake business applications with fabricated tax documents.

- Using stolen identities to apply for loans.

- Claiming inflated payroll numbers to secure larger loans.

- Double-dipping by applying for multiple loans under different business names.

And let’s not forget the big fish. Some high-profile cases involved well-known individuals and companies allegedly siphoning millions of dollars from the program. It’s like a heist movie, but in real life.

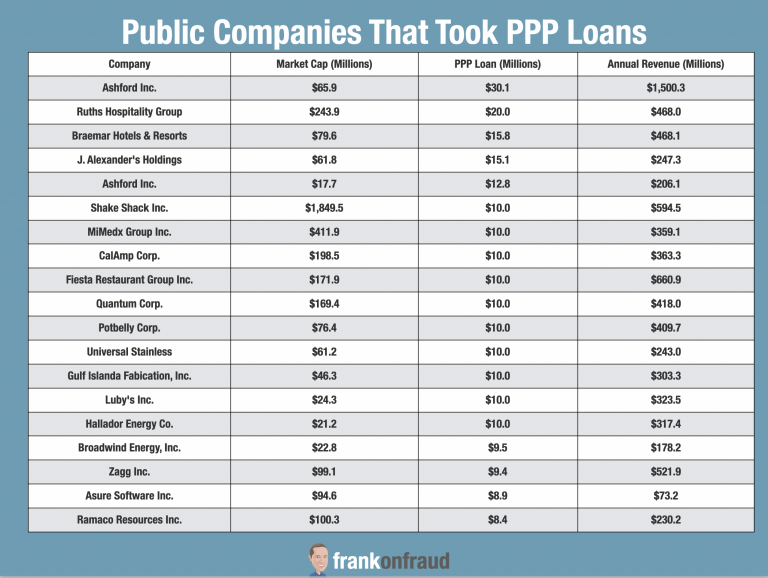

Who’s on the Fraud PPP Loan List?

So, who exactly made the fraud PPP loan list? It’s a mix of small-time scammers and big-name players. From mom-and-pop operations to celebrities and entrepreneurs, the list is surprisingly diverse. Here are a few examples:

Read also:Unveiling The Magic Of Age Of Wonders 4 A Comprehensive Guide

- A former NFL player accused of embezzling over $3.5 million in PPP funds.

- A group of fraudsters who allegedly funneled $100 million in loans into luxury cars and real estate.

- A tech startup founder who used PPP money to buy a $2 million home and a Lamborghini.

These cases aren’t just shocking—they’re infuriating. Taxpayer money meant to support struggling businesses ended up funding lavish lifestyles for a select few. But how did this happen, and why weren’t there more safeguards in place?

Why Was the PPP Program Vulnerable to Fraud?

The short answer? Speed and scale. The PPP program was rolled out in record time to address the urgent needs of small businesses during the pandemic. However, this haste came at a cost. Here are some of the key factors that contributed to the program’s vulnerability:

- Limited oversight: Banks were given the responsibility to approve loans, but they weren’t required to verify much of the information provided by applicants.

- Relaxed documentation requirements: Businesses only needed to submit a few documents, making it easier for fraudsters to falsify information.

- High demand: With millions of businesses applying for loans, it was challenging to thoroughly review each application.

Don’t get me wrong—most businesses used the funds responsibly. But the sheer volume of applications and the lack of rigorous checks created opportunities for bad actors to slip through the cracks.

What Are the Consequences of PPP Fraud?

The consequences of PPP fraud go beyond just lost money. Here’s what’s at stake:

- Economic impact: Misused funds mean less money available for legitimate businesses in need.

- Reputational damage: The scandal has tarnished the reputation of the PPP program and the businesses involved.

- Legal action: Many individuals and companies on the fraud PPP loan list are facing criminal charges, including wire fraud, bank fraud, and money laundering.

And let’s not forget the emotional toll on small business owners who played by the rules. Watching others game the system can be disheartening, to say the least.

How Are Authorities Cracking Down on PPP Fraud?

Thankfully, authorities are taking action to hold fraudsters accountable. The Department of Justice (DOJ) has launched a massive investigation into PPP fraud, resulting in hundreds of arrests and indictments. Here’s what they’re doing:

- Working with banks and financial institutions to identify suspicious transactions.

- Using data analytics to detect patterns of fraud across applications.

- Collaborating with law enforcement agencies to prosecute those responsible.

And it’s not just about catching the bad guys. The DOJ is also focused on recovering stolen funds and ensuring that taxpayer money is returned to its rightful place—supporting struggling businesses and communities.

What Can Businesses Do to Avoid Fraud?

While the focus is often on catching fraudsters, it’s equally important for businesses to take steps to avoid unintentional mistakes or missteps. Here are some tips:

- Keep detailed records of how PPP funds are used.

- Consult with a financial advisor or accountant to ensure compliance with program rules.

- Stay informed about updates and changes to the PPP program.

By taking these precautions, businesses can protect themselves from potential scrutiny and ensure they’re using funds appropriately.

Lessons Learned from the PPP Fraud Scandal

So, what have we learned from the fraud PPP loan list scandal? A few key takeaways stand out:

- Transparency and accountability matter. Programs like the PPP need robust oversight to prevent misuse of funds.

- Technology can be both a blessing and a curse. While data analytics helped identify fraud, it also highlighted the need for better safeguards in the application process.

- Public trust is fragile. When taxpayer money is misused, it erodes confidence in government programs and initiatives.

As we move forward, it’s crucial to learn from these mistakes and implement reforms to prevent future fraud. Because let’s face it—there will always be bad actors looking for loopholes to exploit.

What’s Next for the PPP Program?

With the PPP program winding down, the focus is now on accountability and recovery. Here’s what’s next:

- Ongoing investigations into fraud cases.

- Repayment of misused funds to the SBA.

- Policy reforms to improve the design and implementation of future relief programs.

While the scandal has cast a shadow over the PPP program, it’s important to remember that the vast majority of funds were used for their intended purpose—supporting small businesses and preserving jobs. Let’s not lose sight of that.

Final Thoughts

As we wrap up this deep dive into the fraud PPP loan list, one thing is clear: the scandal has exposed both the strengths and weaknesses of the PPP program. While it succeeded in providing critical support to millions of businesses, it also highlighted the need for stronger safeguards to prevent fraud.

So, what can you do? First, stay informed about developments in the investigation and policy reforms. Second, if you’re a business owner, make sure you’re following all the rules and keeping accurate records. And finally, remember that accountability starts with each of us.

Got thoughts or questions about the fraud PPP loan list? Drop a comment below or share this article with your network. Together, we can keep the conversation going and work toward a more transparent and accountable future.

Table of Contents

- Fraud PPP Loan List: The Shocking Truth Behind the Numbers

- What is the PPP Program Anyway?

- How Did Fraud Happen in the PPP Program?

- Who’s on the Fraud PPP Loan List?

- Why Was the PPP Program Vulnerable to Fraud?

- What Are the Consequences of PPP Fraud?

- How Are Authorities Cracking Down on PPP Fraud?

- What Can Businesses Do to Avoid Fraud?

- Lessons Learned from the PPP Fraud Scandal

- What’s Next for the PPP Program?

- Final Thoughts

Article Recommendations