E Treasury TD Bank: Your Ultimate Guide To Simplify Financial Management

Hey there, finance enthusiasts! Ever wondered how you can streamline your financial operations with just one platform? Well, let me introduce you to the game-changer: E Treasury TD Bank. If you're like most people, managing finances can be overwhelming. But don't worry, this solution is here to make your life easier. In this article, we'll dive deep into what E Treasury TD Bank is all about and why it's a must-have for both businesses and individuals.

Let’s face it—money management is no joke. You need a system that’s reliable, user-friendly, and packed with features to help you stay on top of your finances. E Treasury TD Bank is not just another banking tool; it’s a powerful ally in your financial journey. Whether you’re handling payroll, monitoring cash flow, or managing multiple accounts, this platform has got you covered.

Now, if you’re still on the fence about whether E Treasury TD Bank is worth your time, stick around because we’re about to break it down for you. From its core functionalities to advanced features, we’ll explore everything you need to know. So grab a cup of coffee, sit back, and let’s get started!

Read also:How To Manage A Fleet Of Raspberry Pi For Free A Comprehensive Guide

What Exactly is E Treasury TD Bank?

Alright, so let’s start with the basics. E Treasury TD Bank is essentially an online platform designed to help businesses and individuals manage their finances more efficiently. It’s like having a personal finance assistant right at your fingertips. Whether you’re a small business owner or someone who wants to keep track of personal expenses, this tool is tailored to meet your needs.

Here’s the deal: E Treasury TD Bank offers a range of features that simplify financial operations. From account reconciliation to payment processing, it’s all done in one place. Plus, the platform is super secure, ensuring your data is protected at all times. In today’s digital age, where cyber threats are real, knowing your information is safe is a huge relief.

But why stop there? E Treasury TD Bank also integrates seamlessly with other financial systems, making it a versatile choice for anyone looking to upgrade their money management game. So whether you’re dealing with international transactions or local payments, this platform has got you sorted.

Key Features of E Treasury TD Bank

Now that we’ve covered the basics, let’s talk about what makes E Treasury TD Bank stand out. Here are some of the key features that set it apart from the competition:

- Secure Payment Processing: Say goodbye to manual checks and hello to streamlined payments.

- Real-Time Reporting: Get instant access to financial data and insights to make informed decisions.

- Multi-Currency Support: Handle transactions in multiple currencies without breaking a sweat.

- Customizable Dashboards: Tailor your dashboard to suit your specific needs and preferences.

- Advanced Fraud Detection: Stay one step ahead with cutting-edge fraud prevention tools.

These features are just the tip of the iceberg. E Treasury TD Bank offers so much more, and we’ll dive deeper into each of these functionalities later in the article. For now, just know that this platform is packed with tools to make your financial life easier.

Why Choose E Treasury TD Bank Over Other Platforms?

When it comes to financial management tools, you’ve got plenty of options. But why should you choose E Treasury TD Bank? Well, for starters, it’s backed by one of the largest and most trusted banks in the world—TD Bank. That alone gives it a level of credibility that’s hard to match.

Read also:Colin Hanks The Versatile Actor And Filmmaker You Need To Know

Moreover, E Treasury TD Bank offers a user-friendly interface that’s easy to navigate, even for those who aren’t tech-savvy. The platform is designed with the end user in mind, ensuring that everything is intuitive and straightforward. Plus, with 24/7 customer support, you’ll always have someone to turn to if you run into any issues.

Let’s not forget about scalability. Whether you’re a small startup or a large corporation, E Treasury TD Bank can grow with your business. It’s flexible enough to adapt to changing needs, making it a long-term solution for your financial management needs.

How Does E Treasury TD Bank Benefit Businesses?

For businesses, E Treasury TD Bank is a game-changer. It helps streamline operations, reduce costs, and improve efficiency. Here’s how:

Improved Cash Flow Management

With E Treasury TD Bank, businesses can easily track their cash flow in real-time. This means no more surprises when it comes to invoicing or payments. You’ll always know where your money is and where it’s going, allowing you to make smarter financial decisions.

Enhanced Security Measures

Security is a top priority for any business, and E Treasury TD Bank doesn’t disappoint. With advanced encryption and fraud detection tools, your financial data is always protected. Plus, the platform complies with all the necessary regulations, giving you peace of mind.

Streamlined Payment Processes

Gone are the days of manual checks and paper trails. E Treasury TD Bank automates the entire payment process, saving you time and reducing errors. Whether you’re paying vendors or processing payroll, everything is done seamlessly through the platform.

Personal Finance Management with E Treasury TD Bank

But it’s not just businesses that benefit from E Treasury TD Bank. Individuals can also use this platform to manage their personal finances more effectively. Here’s how:

Easy Account Reconciliation

Reconciling accounts can be a hassle, but with E Treasury TD Bank, it’s a breeze. The platform automatically matches transactions, making it easy to keep track of your spending and savings.

Real-Time Alerts and Notifications

Stay on top of your finances with real-time alerts and notifications. Whether it’s a low balance warning or a suspicious transaction alert, you’ll always be in the loop.

Customizable Budgeting Tools

Create personalized budgets and track your progress with E Treasury TD Bank’s customizable budgeting tools. It’s like having a financial planner in your pocket.

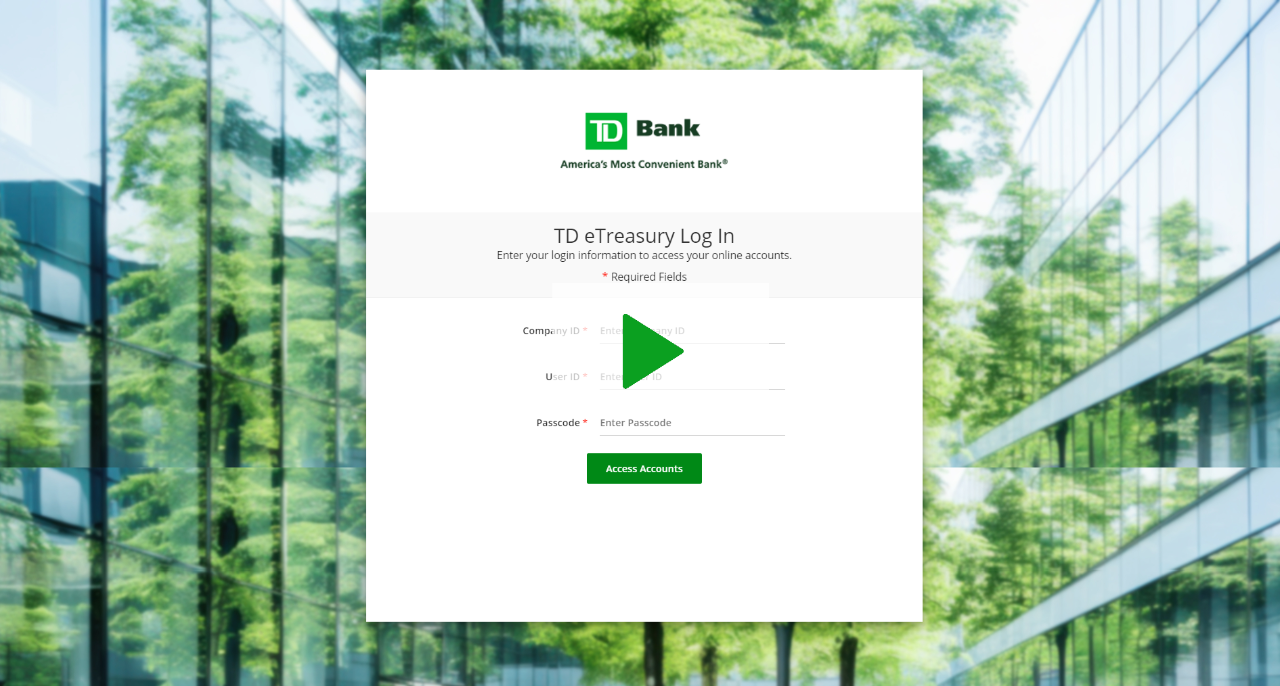

Getting Started with E Treasury TD Bank

Ready to take the plunge? Here’s a step-by-step guide to getting started with E Treasury TD Bank:

- Sign up for an account on the TD Bank website.

- Complete the registration process and verify your identity.

- Link your existing TD Bank accounts to the platform.

- Explore the dashboard and familiarize yourself with the features.

- Start using the platform to manage your finances.

It’s that simple! With E Treasury TD Bank, you’ll be up and running in no time.

Cost and Pricing of E Treasury TD Bank

Now, let’s talk about the elephant in the room—cost. How much does E Treasury TD Bank cost? Well, the good news is that it’s free for TD Bank account holders. However, there may be additional fees for certain features or services, so it’s always a good idea to check with your bank representative for the full details.

For businesses, there may be tiered pricing options depending on the size and complexity of your operations. Again, it’s best to consult with a TD Bank advisor to get a customized quote based on your specific needs.

Security and Privacy with E Treasury TD Bank

When it comes to financial platforms, security is always a concern. But rest assured, E Treasury TD Bank takes security very seriously. Here are some of the measures in place to protect your data:

- End-to-End Encryption: All data is encrypted to prevent unauthorized access.

- Two-Factor Authentication: Add an extra layer of security with two-factor authentication.

- Regular Security Audits: The platform undergoes regular security audits to ensure compliance with industry standards.

Privacy is also a top priority. E Treasury TD Bank adheres to strict privacy policies, ensuring that your personal and financial information is kept confidential.

Customer Support and Resources

Let’s face it—no matter how user-friendly a platform is, you’re bound to run into questions or issues at some point. That’s where E Treasury TD Bank’s customer support comes in. Here’s what you can expect:

24/7 Support

Whether it’s day or night, you can always reach out to E Treasury TD Bank’s customer support team for assistance. They’re available around the clock to help you with any issues you may encounter.

Comprehensive Help Center

Can’t find what you’re looking for? Check out the E Treasury TD Bank help center. It’s packed with articles, tutorials, and FAQs to help you get the most out of the platform.

Live Chat and Phone Support

Prefer a more direct approach? No problem! You can chat with a live agent or call customer support for instant help.

Conclusion: Is E Treasury TD Bank Right for You?

So there you have it—everything you need to know about E Treasury TD Bank. Whether you’re a business owner or an individual looking to simplify your financial management, this platform has something to offer everyone. With its robust features, advanced security measures, and excellent customer support, it’s no wonder why so many people are making the switch.

Ready to take control of your finances? Don’t wait—sign up for E Treasury TD Bank today and see the difference it can make. And remember, if you found this article helpful, don’t forget to share it with your friends and family. Who knows? You might just be helping them out too!

Table of Contents

- What Exactly is E Treasury TD Bank?

- Key Features of E Treasury TD Bank

- Why Choose E Treasury TD Bank Over Other Platforms?

- How Does E Treasury TD Bank Benefit Businesses?

- Personal Finance Management with E Treasury TD Bank

- Getting Started with E Treasury TD Bank

- Cost and Pricing of E Treasury TD Bank

- Security and Privacy with E Treasury TD Bank

- Customer Support and Resources

- Conclusion: Is E Treasury TD Bank Right for You?

Article Recommendations