Mobile Wallet PNC: Your Ultimate Guide To Simplified Digital Payments

Hey there, folks! Listen up because we’re diving deep into the world of mobile wallet PNC. In today’s fast-paced digital era, the way we handle money has completely transformed. Gone are the days when carrying cash or swiping credit cards were the only options. Now, with the rise of mobile wallets, managing finances has never been easier. And guess what? PNC Bank is stepping up its game with its very own mobile wallet solution. This is not just a fancy app; it’s a game-changer for how you manage your money on the go. So, let’s break it down and explore why this is something you need to know about.

Mobile wallets are no longer a luxury—they’ve become a necessity. With PNC’s mobile wallet, you’re not just getting a tool to pay for your coffee or groceries. You’re getting access to a secure, reliable, and super convenient way to manage your finances. Whether you’re paying bills, sending money to friends, or even tracking your expenses, PNC’s mobile wallet has got you covered. It’s like having a personal finance assistant right in your pocket.

Now, before we dive deeper, let’s get one thing straight: mobile wallets are here to stay. The convenience, security, and versatility they offer are unmatched. And with PNC’s reputation for reliability and innovation, their mobile wallet is worth exploring. So, buckle up because we’re about to take you on a journey through the ins and outs of mobile wallet PNC. Trust me, by the end of this, you’ll be wondering how you ever lived without it.

Read also:Does Patrick Mahomes Daughter Have Special Needs A Comprehensive Insight

What Exactly is Mobile Wallet PNC?

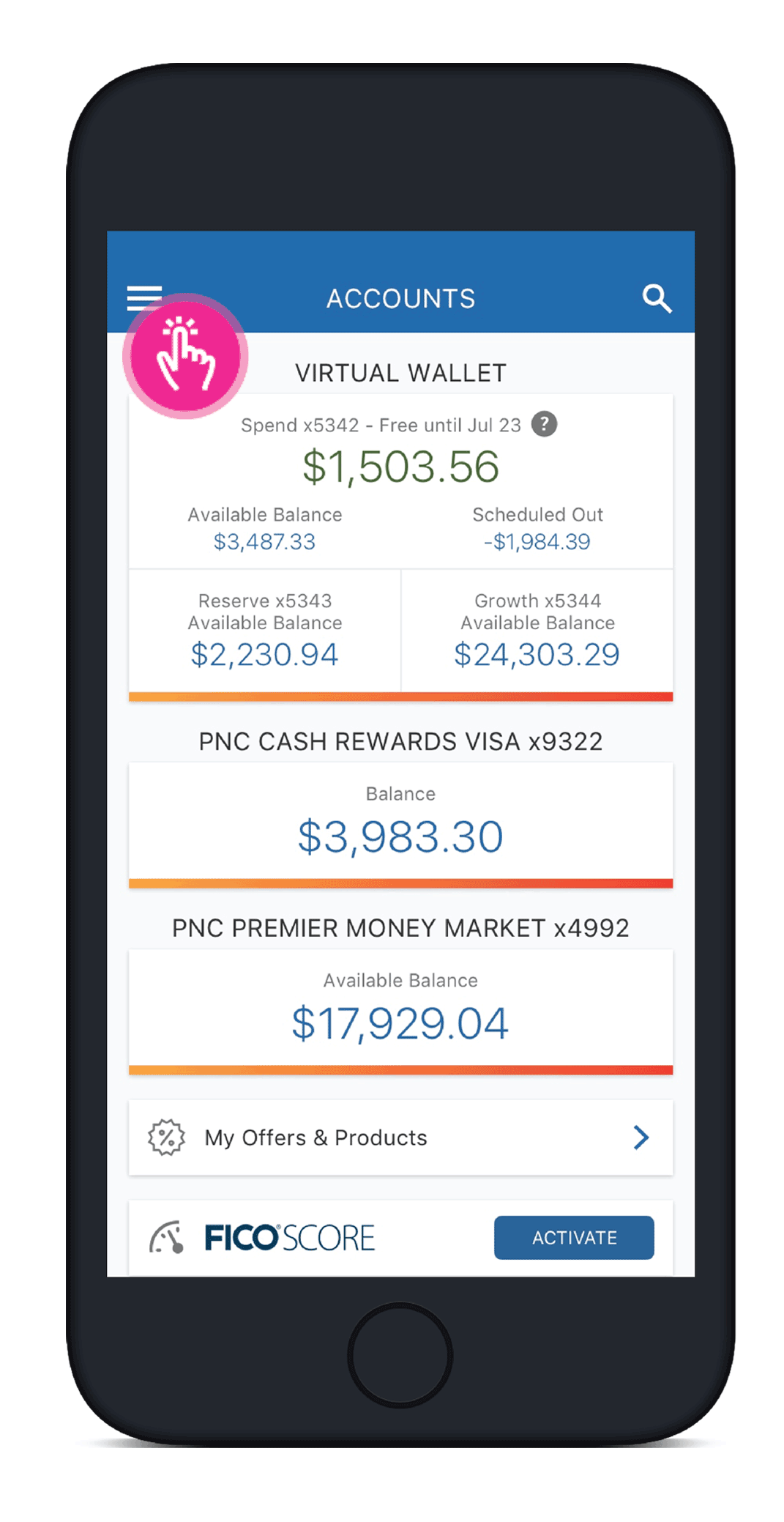

Let’s start with the basics, shall we? A mobile wallet PNC is essentially a digital wallet offered by PNC Bank that allows you to store your payment information securely on your smartphone. Think of it as a virtual version of your physical wallet, but way cooler and way more secure. With this app, you can make payments, transfer money, check your account balance, and even manage your PNC credit cards—all from your phone.

Here’s the kicker: it’s not just about convenience. PNC’s mobile wallet is packed with features that make managing your finances a breeze. For instance, you can set up automatic bill payments, track your spending habits, and even earn rewards for using the app. Plus, the security measures in place are top-notch, ensuring your sensitive information stays safe from prying eyes.

Why Should You Care About Mobile Wallet PNC?

Alright, so you might be thinking, “Why should I bother with a mobile wallet when I’ve been doing just fine with my old-school methods?” Well, let me tell you why. First off, mobile wallet PNC is all about simplicity. No more fumbling around for cash or cards when you’re at the checkout counter. With just a tap of your phone, you can complete transactions in seconds.

Secondly, it’s incredibly secure. PNC uses advanced encryption and tokenization technology to protect your data. This means that even if someone gets ahold of your phone, they won’t be able to access your financial information without the proper authentication. And let’s not forget the peace of mind that comes with knowing your transactions are being monitored for fraud in real-time.

Key Features of Mobile Wallet PNC

So, what makes PNC’s mobile wallet stand out from the crowd? Let’s break it down:

- Seamless Payments: Pay for goods and services at thousands of merchants with just a tap.

- Account Management: Check your balances, view transaction history, and manage your accounts all in one place.

- Security Features: Advanced encryption, biometric authentication, and real-time fraud monitoring keep your info safe.

- Convenience: Access your PNC accounts anytime, anywhere, without the need for physical cards.

- Rewards Program: Earn points or cashback for using your mobile wallet for everyday purchases.

How Does Mobile Wallet PNC Work?

Using PNC’s mobile wallet is as easy as pie. First, you’ll need to download the PNC Mobile app onto your smartphone. Once installed, log in with your PNC credentials and follow the prompts to set up your mobile wallet. You’ll need to add your PNC debit or credit card to the app, and voilà—you’re ready to go.

Read also:Explore The Best Hibbett Womens Shoes Styles Comfort And Trends

When it’s time to make a payment, simply open the app, select the card you want to use, and hold your phone near the contactless payment terminal. That’s it! The transaction will be processed instantly, and you’ll receive a confirmation on your phone. It’s that simple.

Setting Up Your Mobile Wallet PNC

Here’s a quick step-by-step guide to setting up your PNC mobile wallet:

- Download the PNC Mobile app from the App Store or Google Play.

- Log in using your PNC account credentials.

- Go to the “Wallet” section and select “Add Card.”

- Follow the prompts to add your PNC debit or credit card.

- Set up any additional security features, such as biometric authentication.

And just like that, you’re all set to start using your mobile wallet!

Security Measures in Mobile Wallet PNC

Security is a top priority when it comes to digital payments, and PNC’s mobile wallet doesn’t disappoint. The app uses a combination of encryption, tokenization, and biometric authentication to keep your data safe. Here’s how it works:

- Encryption: Your payment information is encrypted both in transit and at rest, ensuring that it can’t be intercepted by hackers.

- Tokenization: Instead of transmitting your actual card number, the app uses a unique token that’s useless to anyone who might intercept it.

- Biometric Authentication: You can set up fingerprint or facial recognition to add an extra layer of security when accessing your wallet.

- Real-Time Fraud Monitoring: PNC continuously monitors your transactions for suspicious activity and will alert you if anything seems off.

With these measures in place, you can rest easy knowing that your financial information is in good hands.

Common Security Concerns and How PNC Addresses Them

Some people might be hesitant to adopt mobile wallets due to concerns about security. However, PNC has thought of everything. For instance, if you lose your phone, you can remotely disable access to your mobile wallet through the PNC Mobile app. Additionally, all transactions require authentication, so even if someone gets ahold of your phone, they won’t be able to access your accounts without the proper credentials.

Benefits of Using Mobile Wallet PNC

Now that we’ve covered the basics, let’s talk about why you should switch to PNC’s mobile wallet. Here are just a few benefits:

- Convenience: No more carrying around physical cards or cash. Everything you need is right in your phone.

- Security: Advanced encryption and biometric authentication keep your data safe.

- Speed: Transactions are processed instantly, saving you time at the checkout counter.

- Control: Easily manage your accounts, set spending limits, and monitor your transactions.

- Rewards: Earn points or cashback for using your mobile wallet for everyday purchases.

Who wouldn’t want all these benefits in one app? It’s like having a personal finance assistant in your pocket.

How Mobile Wallet PNC Saves You Time and Money

One of the biggest advantages of PNC’s mobile wallet is how it helps you save time and money. By streamlining your financial transactions, you can focus on more important things in life. Plus, with features like automatic bill payments and expense tracking, you’ll never miss a payment or go over budget again.

Challenges and Limitations of Mobile Wallet PNC

While PNC’s mobile wallet is a fantastic tool, it’s not without its limitations. For starters, not all merchants accept contactless payments, so you may still need to carry a physical card in some situations. Additionally, if you’re not tech-savvy, setting up and using the app might seem a bit daunting at first.

That being said, PNC is constantly working to improve the app and expand its capabilities. They’re also offering excellent customer support to help users get the most out of their mobile wallet experience.

How to Overcome Common Challenges

If you’re concerned about any of these limitations, don’t worry. Here are a few tips to help you make the most of your PNC mobile wallet:

- Check with merchants beforehand to see if they accept contactless payments.

- Take advantage of PNC’s customer support resources to get help with setup and troubleshooting.

- Explore all the features of the app to discover new ways to manage your finances.

With a little effort, you’ll be a mobile wallet pro in no time!

Comparing Mobile Wallet PNC with Other Providers

Of course, PNC isn’t the only game in town when it comes to mobile wallets. So, how does PNC’s mobile wallet stack up against the competition? Let’s take a look:

- Security: PNC’s advanced encryption and tokenization technology rivals that of other top providers.

- Features: PNC offers a robust set of features, including account management, rewards programs, and real-time fraud monitoring.

- User Experience: The PNC Mobile app is intuitive and easy to navigate, making it a great choice for both tech-savvy users and newcomers alike.

While other providers may offer similar features, PNC’s reputation for reliability and customer service sets it apart. Plus, if you’re already a PNC customer, integrating your mobile wallet with your existing accounts is a no-brainer.

Why Choose Mobile Wallet PNC Over Competitors?

Ultimately, the decision to choose PNC’s mobile wallet comes down to trust. PNC has been a trusted financial institution for decades, and their commitment to innovation and customer service is evident in their mobile wallet offering. Whether you’re looking for convenience, security, or rewards, PNC has got you covered.

Future of Mobile Wallet PNC

As technology continues to evolve, so too will PNC’s mobile wallet. We can expect to see even more advanced features, such as AI-driven financial advice and expanded payment options. PNC is committed to staying at the forefront of digital finance, ensuring that their customers have access to the latest and greatest tools.

So, what does the future hold for PNC’s mobile wallet? Only time will tell, but one thing’s for sure: it’s going to be exciting!

What to Expect in the Coming Years

Here are a few things to look forward to:

- Enhanced security features, such as AI-powered fraud detection.

- Expanded payment options, including cryptocurrency support.

- Personalized financial advice powered by machine learning.

With these advancements on the horizon, the future of mobile wallets looks brighter than ever.

Conclusion

Well, there you have it—a comprehensive guide to mobile wallet PNC. From its convenience and security to its robust features and rewards program, PNC’s mobile wallet is a game-changer for how we manage our finances. Whether you’re a tech-savvy millennial or a newcomer to digital payments, there’s something in this app for everyone.

So, what are you waiting for? Download the PNC Mobile app today and take the first step toward simplifying your financial life. And don’t forget to leave a comment or share this article with your friends. Who knows? You might just help them discover the power of mobile wallets too.

Table of Contents

Article Recommendations