Mastering Larimer Assessor Property Search: The Ultimate Guide For Property Owners And Buyers

Looking to dive deep into Larimer Assessor Property Search? Well, buckle up because this is going to be an insightful ride. Whether you're a homeowner trying to understand property values or a potential buyer exploring the market, this guide will arm you with all the tools and knowledge you need. This isn't just another article; it's your go-to resource for navigating Larimer County's property assessment system.

Property assessment might sound boring, but trust me, it’s a critical part of the real estate game. Knowing how your property is valued can save you thousands in taxes or help you make smarter investment decisions. And with the Larimer Assessor Property Search tool, you’ve got a powerful ally in your corner. Let’s break down why this matters and how to use it effectively.

Before we get into the nitty-gritty, let’s clear the air. Property assessments aren’t just random numbers thrown at you by the government. They’re calculated using specific criteria, and understanding these can empower you to challenge assessments if needed. So, whether you’re in Fort Collins or any other part of Larimer County, this guide has got your back.

Read also:One Tree Hill Larry Sawyer A Deep Dive Into His Character Legacy And Impact

What is Larimer Assessor Property Search?

Alright, let’s start with the basics. The Larimer Assessor Property Search is an online tool provided by the Larimer County Assessor’s Office. It allows property owners and buyers to access detailed information about properties within the county. Think of it as a treasure map for real estate enthusiasts. You can find everything from property tax assessments to recent sales data.

This tool isn’t just for fun—it’s a serious resource for anyone involved in the real estate market. Whether you’re looking to buy, sell, or simply understand your property’s value, the Larimer Assessor Property Search is your golden ticket. It’s free, easy to use, and packed with valuable insights.

Why Should You Care About Property Assessments?

Here’s the deal: property assessments directly impact your wallet. They determine how much you pay in property taxes, which can be a significant expense. Understanding the assessment process helps you ensure that your property is being fairly valued. If the assessment seems off, you can challenge it and potentially save big bucks.

Plus, if you’re buying a property, knowing its assessed value can help you negotiate a better price. It’s like having insider info in a high-stakes game. The Larimer Assessor Property Search makes it easy to access this information, leveling the playing field for everyone involved.

How Property Assessments Work in Larimer County

Let’s break it down. Property assessments in Larimer County are based on market value, which is determined by analyzing recent sales of similar properties. The assessor’s office also considers factors like location, size, and condition of the property. It’s not just a guess; it’s a data-driven process.

Once the market value is determined, the actual assessed value is calculated by applying a specific assessment rate. For residential properties, this rate is usually around 7.15%, while commercial properties have a higher rate. The final assessed value is what’s used to calculate your property taxes.

Read also:Total Eclipse Of The Heart The Iconic Song And Its Band

Step-by-Step Guide to Using Larimer Assessor Property Search

Now that you know why this tool is important, let’s walk through how to use it. It’s super straightforward, but having a step-by-step guide never hurts, right?

First things first, head over to the official Larimer County Assessor’s website. Look for the “Property Search” option and click on it. You’ll be taken to a search page where you can enter details about the property you’re interested in.

Here’s what you can search by:

- Address

- Owner Name

- Parcel Number

- Sales History

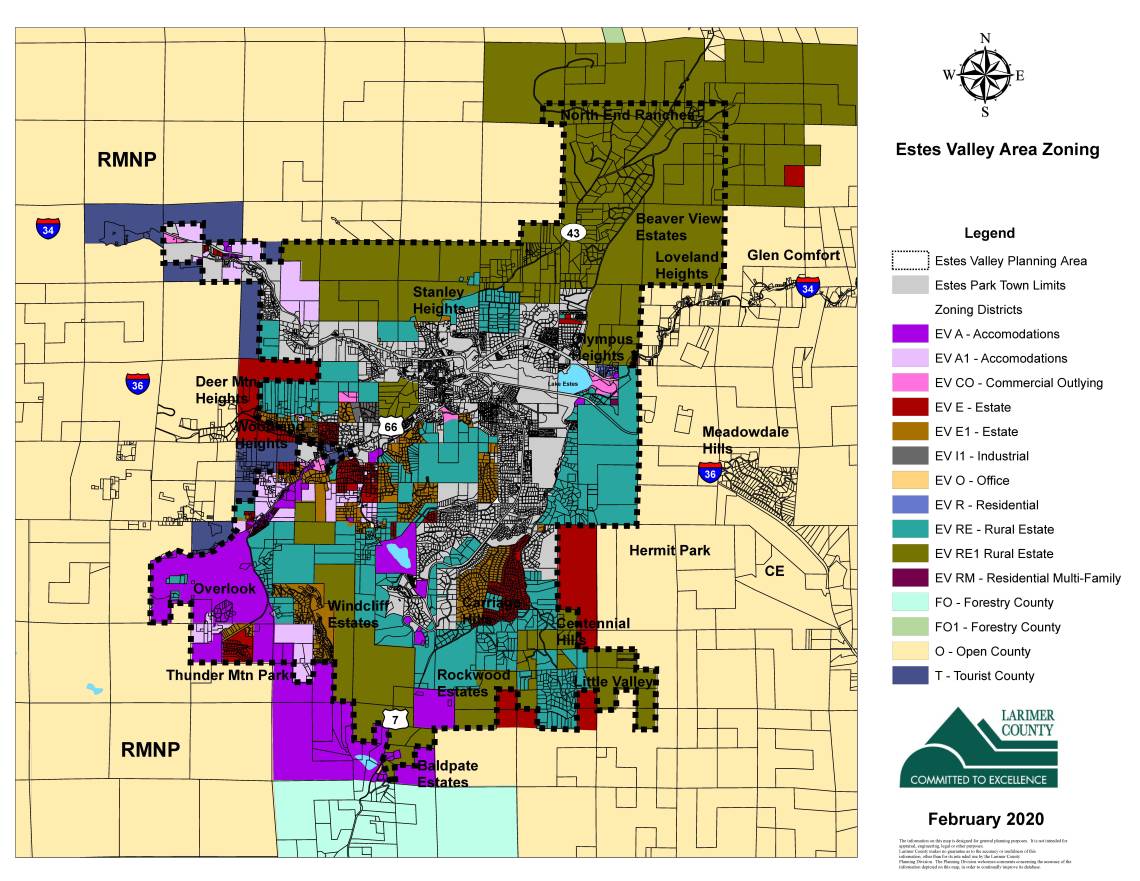

Once you enter your search criteria, hit submit, and voila! You’ll get a detailed report on the property. It includes everything from tax information to zoning details. It’s like having a personal assistant for all your property-related queries.

Tips for Maximizing Your Search

Here are a few tips to make the most of your Larimer Assessor Property Search:

- Use the parcel number if you have it. It’s the most accurate way to find a property.

- Check the sales history to see how the property’s value has changed over time.

- Look at comparable properties in the area to get a better sense of market trends.

Understanding Property Tax Rates in Larimer County

Property taxes are a big deal, and they’re calculated based on the assessed value of your property. In Larimer County, the tax rate varies depending on factors like location and property type. Residential properties generally have lower rates compared to commercial ones.

For example, if your property is assessed at $300,000, and the residential assessment rate is 7.15%, your taxable value would be around $21,450. Multiply that by the mill levy (tax rate) for your area, and you’ll get your annual property tax bill. It’s a simple formula, but it can get complicated when you factor in exemptions and deductions.

Common Property Tax Exemptions

Did you know you might qualify for property tax exemptions? Here are a few common ones:

- Homestead Exemption: Available for homeowners aged 65 or older.

- Disability Exemption: For homeowners with qualifying disabilities.

- Renewable Energy Exemption: For properties with solar panels or other renewable energy systems.

Make sure to check if you qualify for any of these exemptions. They can significantly reduce your tax burden.

Challenging Your Property Assessment

What if you think your property assessment is too high? Don’t worry; you can challenge it. The Larimer Assessor Property Search can actually help you build your case by providing data on comparable properties. If you find similar properties with lower assessments, you can use that info to support your appeal.

Here’s how the process works:

- Submit a written appeal to the Larimer County Assessor’s Office.

- Include evidence, such as comparable property assessments and recent sales data.

- Attend a hearing if necessary to present your case.

Remember, challenging an assessment isn’t always easy, but it can be worth it if you’re overpaying on your property taxes.

How to Prepare for an Appeal

Here are some tips to help you prepare for a successful appeal:

- Gather as much data as possible using the Larimer Assessor Property Search.

- Document any changes or improvements to your property that might affect its value.

- Consult with a real estate professional if you’re unsure about the process.

Exploring Market Trends in Larimer County

Understanding market trends is crucial for anyone involved in real estate. The Larimer Assessor Property Search can give you insights into how property values are changing in different areas of the county. This info can help you make informed decisions about buying, selling, or investing in property.

For instance, if you notice a trend of increasing property values in a particular neighborhood, it might be a good time to invest there. On the flip side, if values are declining, you might want to reconsider your plans. Staying on top of these trends gives you a competitive edge in the market.

Key Factors Influencing Property Values

Several factors can influence property values in Larimer County. Here are a few to keep an eye on:

- Economic Conditions: A strong local economy can boost property values.

- Infrastructure Development: New roads, schools, and other infrastructure can increase demand for properties.

- Population Growth: As more people move to the area, property values tend to rise.

Utilizing Larimer Assessor Property Search for Investment

If you’re a real estate investor, the Larimer Assessor Property Search is your secret weapon. It allows you to analyze the market, identify undervalued properties, and track trends over time. This data-driven approach can help you make smarter investment decisions.

For example, you might use the tool to find properties with high rental potential or those that are ripe for renovation and resale. The possibilities are endless, and with the right strategy, you can turn a profit in no time.

Strategies for Successful Real Estate Investing

Here are a few strategies to consider:

- Focus on high-growth areas where property values are expected to increase.

- Look for properties with good rental yields if you’re interested in passive income.

- Consider fix-and-flip opportunities for quick returns.

Conclusion: Take Control of Your Real Estate Journey

There you have it—the ultimate guide to mastering Larimer Assessor Property Search. Whether you’re a homeowner, buyer, or investor, this tool can help you navigate the real estate market with confidence. By understanding property assessments, tax rates, and market trends, you’re armed with the knowledge to make informed decisions.

So, what are you waiting for? Head over to the Larimer County Assessor’s website and start exploring. And don’t forget to share this guide with anyone who might find it useful. Together, we can all become smarter real estate players. Now go out there and conquer the market!

Table of Contents

- What is Larimer Assessor Property Search?

- Why Should You Care About Property Assessments?

- How Property Assessments Work in Larimer County

- Step-by-Step Guide to Using Larimer Assessor Property Search

- Understanding Property Tax Rates in Larimer County

- Challenging Your Property Assessment

- Exploring Market Trends in Larimer County

- Utilizing Larimer Assessor Property Search for Investment

Article Recommendations