Amazon SyncBank: The Game-Changer In Digital Banking Solutions

Amazon SyncBank is a revolutionary concept that’s reshaping the financial landscape as we know it. Imagine a world where your bank operates with the same speed, reliability, and customer obsession as Amazon itself. Sounds like science fiction? Think again. This isn’t just a dream; it’s becoming a reality, and you’re about to dive deep into what makes Amazon SyncBank such a game-changer.

Now, let’s face it, the financial industry hasn’t always been the most innovative. While tech giants like Amazon have been pushing boundaries in e-commerce, logistics, and cloud services, traditional banks have been lagging behind. But with Amazon SyncBank, all that’s about to change. This new venture promises to bring the same level of convenience and efficiency that Amazon customers have come to expect, directly into your banking experience.

So, why should you care? Because Amazon SyncBank isn’t just another fintech buzzword. It’s a serious contender in the world of digital banking, and it could revolutionize how you manage your money. Stick around, because we’re about to break it all down for you.

Read also:Talissa Smalley Nude Understanding The Controversy And Setting The Record Straight

What is Amazon SyncBank?

Let’s start with the basics. Amazon SyncBank isn’t your average bank. It’s a digital-first, customer-centric banking solution designed to streamline your financial life. Unlike traditional banks with their lengthy processes and outdated systems, Amazon SyncBank leverages cutting-edge technology to deliver a seamless banking experience. Think of it as the Amazon Prime of banking—fast, reliable, and tailored to your needs.

Why Amazon SyncBank Matters

Here’s the deal: the way we interact with money is evolving. Cash is becoming obsolete, and digital transactions are the norm. Amazon SyncBank taps into this trend by offering a suite of services that cater to the modern consumer. From instant payments to personalized financial insights, this platform is designed to make your life easier.

The Rise of Digital Banking

Digital banking isn’t new, but it’s gaining momentum. According to a report by Statista, the global digital banking market is projected to reach $7.1 trillion by 2026. That’s a massive number, and it shows just how much potential there is in this space. Amazon SyncBank is poised to capitalize on this growth by offering a unique blend of technology and customer service.

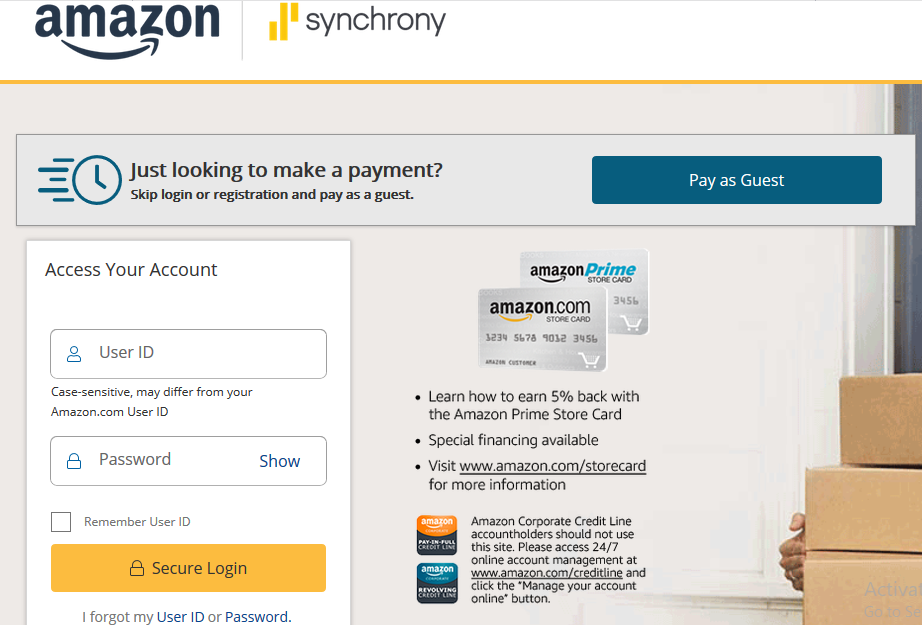

How Amazon SyncBank Works

So, how does it all work? Amazon SyncBank operates on a cloud-based infrastructure, which means no more clunky systems or slow processing times. Everything is powered by Amazon Web Services (AWS), ensuring lightning-fast performance and scalability. Here’s a quick breakdown of the key features:

- Instant Transactions: Say goodbye to waiting days for payments to clear. With Amazon SyncBank, transactions happen in real-time.

- Personalized Insights: Get a clear picture of your financial health with customizable dashboards and analytics.

- Security: Your money is protected by Amazon’s robust security protocols, including encryption and multi-factor authentication.

Amazon SyncBank vs Traditional Banks

Let’s compare apples to oranges—or rather, Amazon SyncBank to traditional banks. Traditional banks often come with hidden fees, limited hours, and a lack of transparency. Amazon SyncBank flips the script by offering:

- No hidden fees

- 24/7 customer support

- Complete transparency

It’s not just about convenience; it’s about giving you control over your finances.

Read also:Isabel May Discovering The Current Partner And Personal Journey

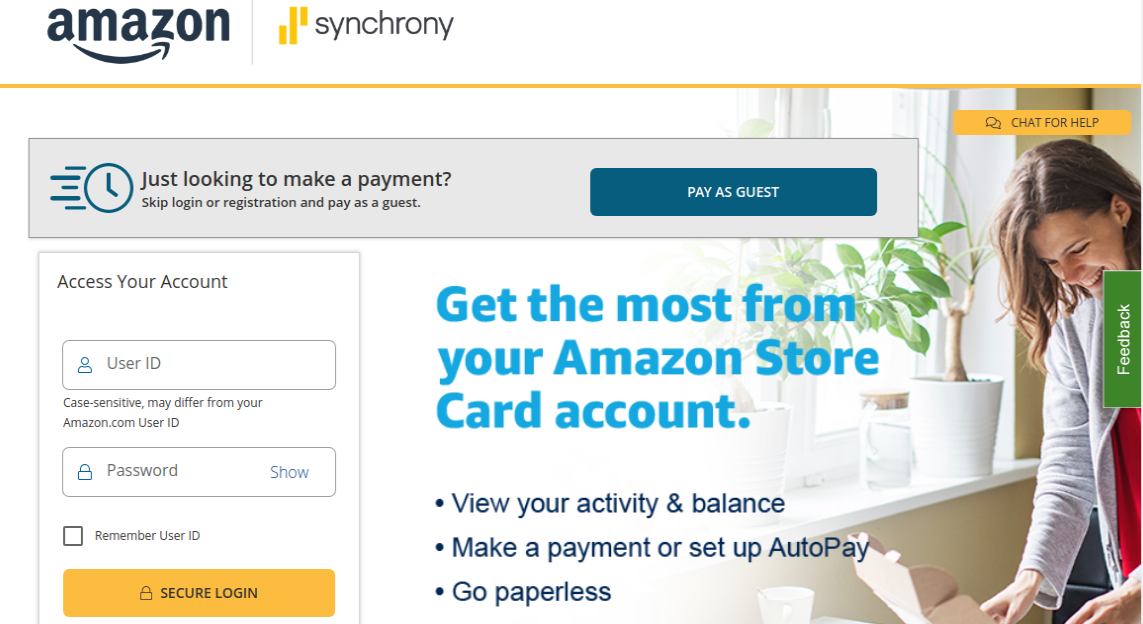

Customer Experience: The Amazon Way

Amazon has always been known for its obsession with customer experience, and Amazon SyncBank is no exception. Every feature is designed with the user in mind, ensuring a smooth and intuitive experience. From the app interface to the onboarding process, everything is streamlined to save you time and hassle.

The Benefits of Amazon SyncBank

So, what’s in it for you? Here are some of the key benefits of using Amazon SyncBank:

- Speed: Faster transactions mean you can access your money when you need it.

- Flexibility: Manage your accounts from anywhere, at any time.

- Security: Rest easy knowing your financial data is protected by top-tier security measures.

Challenges Facing Amazon SyncBank

Of course, no venture is without its challenges. Amazon SyncBank faces some hurdles as it enters the highly regulated banking industry. Regulatory compliance, data privacy concerns, and competition from established players are just a few of the obstacles it must overcome. But with Amazon’s track record of innovation and perseverance, it’s well-positioned to tackle these challenges head-on.

Regulatory Hurdles

One of the biggest challenges is navigating the complex regulatory landscape. Banks are heavily regulated, and Amazon SyncBank must comply with a host of rules and regulations to operate legally. However, Amazon’s experience in navigating regulatory environments in other industries gives it a leg up in this area.

The Future of Amazon SyncBank

Looking ahead, the future looks bright for Amazon SyncBank. With the increasing demand for digital banking solutions, Amazon is well-positioned to capture a significant share of the market. In the coming years, we can expect to see even more features and innovations from this platform, further enhancing the customer experience.

Innovations on the Horizon

Amazon SyncBank is just getting started. Some of the innovations we might see in the future include:

- Integration with other Amazon services

- Advanced AI-driven financial advice

- Expanded international offerings

These advancements could make Amazon SyncBank an even more integral part of your financial life.

Is Amazon SyncBank Right for You?

So, is Amazon SyncBank the right choice for you? That depends on your needs and preferences. If you value speed, convenience, and security, then it’s definitely worth considering. However, if you’re more comfortable with traditional banking methods, it might take some time to adjust.

Who Should Use Amazon SyncBank?

Amazon SyncBank is ideal for tech-savvy individuals who want a modern banking experience. Whether you’re a busy professional or a small business owner, this platform offers the tools you need to manage your finances effectively.

Conclusion

In conclusion, Amazon SyncBank is set to disrupt the banking industry in a big way. By combining Amazon’s technological prowess with a customer-first approach, it offers a banking experience like no other. From instant transactions to personalized insights, this platform has something for everyone.

So, what are you waiting for? Dive into the world of Amazon SyncBank and take control of your financial future. Don’t forget to share your thoughts in the comments below and check out our other articles for more insights into the world of finance and technology.

Table of Contents

Article Recommendations